Capital Structure: 7 Powerful Insights to Know Now

What is Capital Structure?

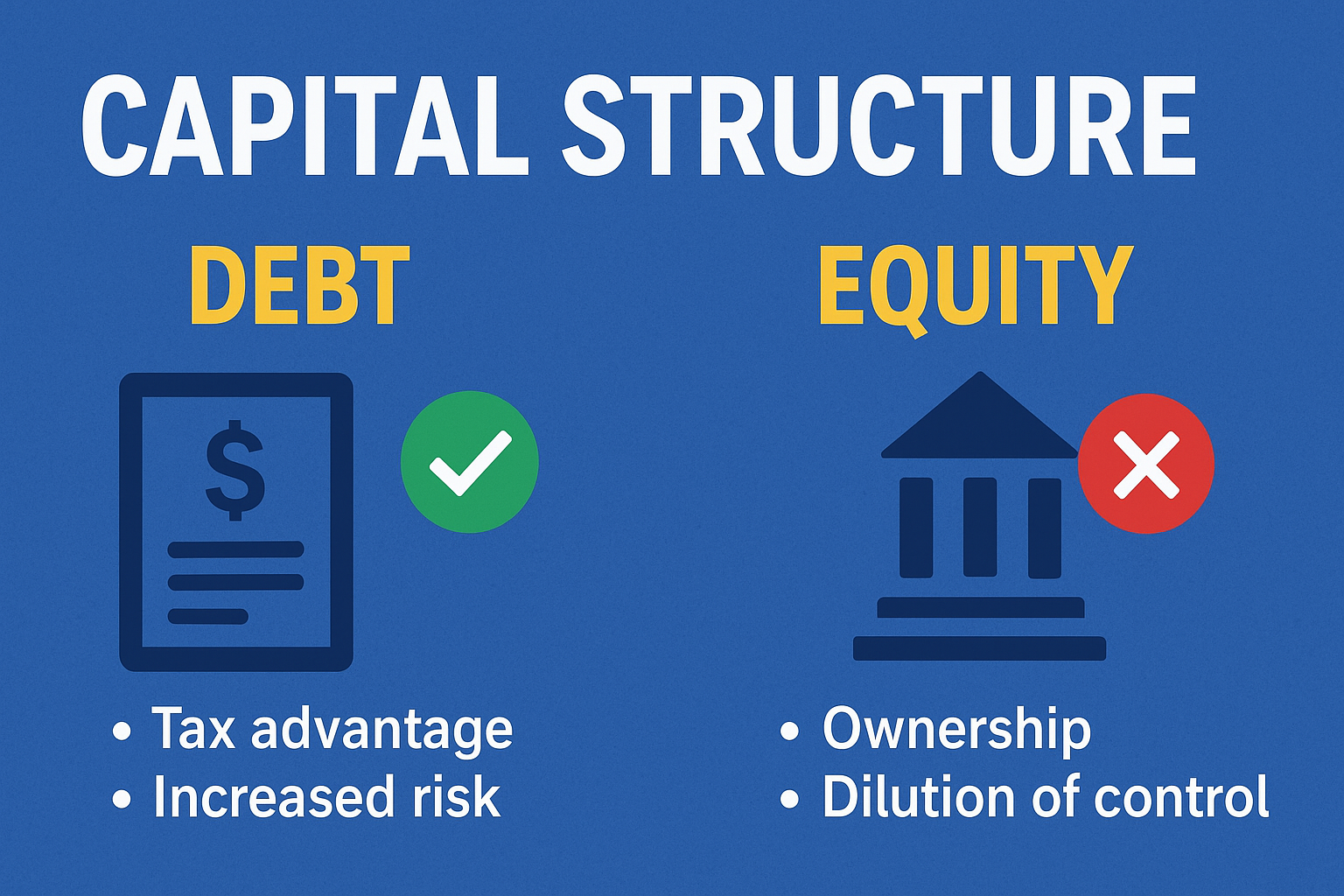

Capital structure refers to the specific mix of a company’s funding sources, which typically includes equity, debt, and other forms of financing. This combination dictates how a business finances its operations and growth, impacting its overall financial strategy and risk profile. The components of capital structure can take various forms; equity financing involves issuing shares to raise funds, while debt financing includes loans, bonds, or lines of credit that the company must repay. Understanding these forms is fundamental for evaluating a company’s fiscal stability and growth potential.

Sign up for HUMANITYUAPD

Equity, often considered a costlier form of financing, represents ownership in the company. Investors who purchase equity stake in the firm expect to receive dividends and enjoy capital appreciation. On the other hand, debt financing may offer tax advantages since interest payments on loans can be deducted from taxable income. However, relying too heavily on debt can increase financial risk and lead to potential bankruptcy if a company is unable to meet its obligations.

The balance between equity and debt is crucial, as it influences a company’s cost of capital—the blend of costs associated with financing its operations through both equity and debt. An optimal capital structure not only minimizes cost but also maximizes the value of the firm. Additionally, it plays a key role in shaping investor confidence and perception of risk. Companies often analyze their capital structure through various metrics, such as the debt-to-equity ratio, to ensure they maintain an effective financial strategy.

In essence, capital structure is a vital aspect for any business, influencing not just current operations but also long-term strategies and investment decisions. A well-defined capital structure can enhance a company’s financial stability and facilitate its growth initiatives, making it an essential focus for corporate management.

➡️ Table of Contents ⬇️

The Importance of Capital Structure

Capital structure refers to the way a company finances its operations and growth through various sources of capital, primarily comprising debt and equity. Understanding capital structure is crucial as it directly influences a company’s financial performance, stability, and risk profile. A well-structured capital arrangement not only fortifies a firm’s balance sheet but also enhances its overall financial health, enabling the organization to navigate through economic fluctuations more effectively.

The relationship between capital structure and financial stability is paramount. Companies with excessive leverage, for instance, may experience heightened vulnerability to market downturns. Conversely, a balanced mix of debt and equity can help in mitigating risks and maintaining a robust financial position. Moreover, the cost of capital is significantly affected by the capital structure; a careful balance can minimize this cost, ensuring that a company can secure funds at optimal rates.

Furthermore, the capital structure plays an integral role in a company’s growth potential. Companies that strategically utilize debt financing can accelerate their expansion efforts, leveraging borrowed funds to invest in new projects or technologies. However, excessive debt can lead to higher interest obligations, which may restrain growth prospects in the long run. Therefore, a well-considered capital structure strategy is essential for fostering sustainable growth while controlling risk.

From the perspective of investors and stakeholders, capital structure is often a key determinant in assessing a company’s financial viability. A strong capital foundation signals stability and prudent management, thus attracting potential investors. Additionally, understanding how stakeholders perceive a company’s capital structure can provide valuable insights for management in making informed strategic decisions. Ultimately, the importance of capital structure cannot be overstated, as it serves as the backbone of a company’s financial strategy and overall performance.

Components of Capital Structure

The capital structure of a company is a fundamental aspect of its financial strategy, detailing how it finances its overall operations and growth through different sources of funds. The primary components of capital structure include equity, debt, preferred stock, and retained earnings. Each of these components plays a crucial role in shaping a company’s financial health and its associated risks.

Equity typically represents the ownership interest in the company, consisting of common stock and additional paid-in capital. When investors purchase equity, they invest in the future profitability of the firm, hoping to gain returns through appreciation in stock price and dividends. However, issuing equity can dilute ownership and control, which can affect decision-making processes within the organization.

On the other hand, debt refers to borrowed funds that a company must repay over time, usually with interest. Debt financing can be advantageous because it does not dilute ownership; however, it introduces financial obligations and potential cash flow issues if the company fails to meet its repayment commitments. Leverage, while it can enhance returns on equity, also increases financial risk, especially in volatile market conditions.

Preferred stock sits between equity and debt, offering features of both. Holders of preferred stock receive dividends before common stockholders and often have a fixed rate of return, which can provide stability in income. Nonetheless, preferred stock can carry less risk than common equity, but it effectively behaves like debt since it requires payment before common dividends can be issued.

Finally, retained earnings represent profits that are reinvested into the company rather than distributed to shareholders. This component signifies a company’s capacity to finance growth internally, reducing reliance on external financing sources. However, it’s essential to balance retained earnings with dividends to maintain investor satisfaction.

Factors Influencing Capital Structure Decisions

The decisions surrounding capital structure are critical for any organization, as they fundamentally affect financial stability and strategic growth. Various factors play a pivotal role in shaping a company’s capital structure choices, including market conditions, interest rates, business risk, tax considerations, and growth opportunities.

Market conditions significantly influence a firm’s capital structure. In a bullish economy, companies are more inclined to leverage debt due to favorable lending conditions, often resulting in lower interest rates. Conversely, during economic downturns, uncertainty may lead companies to adopt a more conservative approach, favoring equity financing over debt to mitigate risk. For instance, during the post-2008 financial crisis, many organizations realized the peril of excessive leverage and shifted towards equity financing to avoid insolvency.

Interest rates are another crucial element impacting capital structure decisions. When interest rates are low, obtaining debt becomes more attractive, enabling firms to finance operations and expand without heavy equity dilution. Conversely, high interest rates can deter borrowing, pushing companies to rely on other financing avenues, such as issuing new shares. For example, in 2020, many firms took advantage of the historically low rates to issue bonds for refinancing existing debt at more favorable terms.

Business risk and tax considerations are intertwined factors that also inform capital structure strategies. Higher business risks often compel companies to maintain a lower level of debt to preserve financial flexibility. Additionally, the tax advantages associated with debt financing, such as interest expense deductions, can be compelling. However, excessive debt can increase the burden of financial distress, as seen in the case of several over-leveraged firms during market turbulence.

Finally, corporate growth opportunities must be evaluated when determining capital structure. Businesses with high growth potential may prefer equity financing to support expansion, while more established firms might leverage debt for efficient growth without diluting ownership. This nuanced approach reflects the dynamic interplay of various influences on capital structure decisions. Ultimately, successful capital structure management requires a comprehensive assessment of these critical factors to align financial strategy with long-term objectives.

Theories of Capital Structure

The concept of capital structure is pivotal in corporate finance, guiding how companies finance their operations and growth. Several key theories have emerged over time, explaining the factors influencing capital structure decisions. These theories provide essential frameworks for organizations to optimize their financial strategies.

Firstly, the Modigliani-Miller theorem, formulated by Franco Modigliani and Merton Miller in the 1950s, posits that, in a frictionless market, the value of a firm is independent of its capital structure. The theorem asserts that regardless of how a company finances itself—whether through debt or equity—the overall market value remains unchanged. However, this theory has limitations in real-world scenarios, particularly due to factors such as taxes, bankruptcy costs, and agency costs, which can make an optimal capital structure a critical component of value maximization.

Next is the trade-off theory, which suggests that companies strive to balance the tax benefits of debt financing against the costs of potential financial distress. It highlights the importance of leveraging debt to take advantage of tax shields while being mindful of the risks associated with high debt levels. Companies thus assess an optimal mix of debt and equity to minimize overall costs and maximize firm value.

Another significant perspective is the pecking order theory, proposed by Stewart Myers and Nicholas Majluf. This theory emphasizes a hierarchy in financing choices, where internally generated funds are preferred over external funding, and debt is favored over equity when external financing is necessary. It suggests that companies prioritize financing sources based on the relative costs of information asymmetry and signal to the market, influencing their capital structure decisions.

Lastly, the market timing theory asserts that firms optimize their capital structures based on market conditions and timing. Companies may issue equity when stock prices are high and opt for debt when interest rates are low, aiming to exploit favorable situations for financing. This theory acknowledges that external market conditions can play a significant role in shaping capital structure strategies.

Optimal Capital Structure: Finding the Right Balance

Optimal capital structure refers to the ideal mix of debt and equity financing that minimizes a company’s cost of capital while maximizing its overall value. A firm’s capital structure is fundamental to its financial strategy, as it influences investment decisions, risk management, and ultimately, shareholder returns. Achieving an optimal capital structure involves navigating various trade-offs, such as the benefits of lower-cost debt against the potential risks associated with increased financial leverage.

One of the primary tools for evaluating a company’s capital structure is the Weighted Average Cost of Capital (WACC). WACC calculates the average rates of return on equity and debt, adjusted for the proportion of each in the firm’s capital structure. A lower WACC indicates a more efficient structure, as it suggests the business is able to finance its operations at a reduced cost. Additionally, companies often use metrics such as the debt-to-equity ratio to assess their financial leverage and gauge how much of their financing comes from debt versus equity. This ratio provides insights into the level of financial risk a company is willing to undertake and how it might affect its capital costs.

Further, it is essential for companies to consider market conditions, their unique business model, and industry standards when determining their optimal capital structure. Companies operating in stable environments may benefit from higher levels of debt due to the predictability of their cash flows, while firms in volatile sectors might lean towards equity financing to maintain flexibility and reduce risk exposure. Balancing the cost of financing with the associated risks requires careful analysis and strategic decision-making, ensuring that the capital structure aligns with the company’s long-term objectives.

Capital Structure in Different Industries

The concept of capital structure varies significantly across different industries, influenced by a range of factors including operational risk, growth potential, and market competition. Each industry exhibits distinct challenges that shape its financing decisions, leading to tailored capital structures. For example, the technology sector typically emphasizes equity financing to support innovation and rapid growth. Tech firms often need substantial capital for research and development, and they prioritize maintaining flexibility, which can be compromised by high debt levels.

Conversely, the manufacturing industry presents a different landscape. Manufacturing companies frequently adopt a more conservative approach to capital structure, relying more on debt. This reliance is due to the substantial costs associated with equipment and facilities, which can be financed through loans. Debt financing here can be advantageous as it allows firms to leverage tax advantages; however, it increases financial risk, especially in volatile markets. A case study of a leading automotive manufacturer illustrates this point, as they utilize a significant amount of debt to finance their large-scale production facilities, which in turn enhances their capacity to meet market demand efficiently.

Service industries, on the other hand, often adopt a mixed approach. Firms in sectors such as consulting or hospitality may appear less asset-heavy, yet their capital structure reflects a balance between equity and debt. This flexibility is crucial for adapting to changing market conditions and maintaining liquidity. For instance, a well-known hotel chain uses a combination of equity financing for expansion and debt financing to manage operational costs. The decisions made regarding capital structure in service industries are also influenced by factors like consumer demand cycles and competitive pressures.

This analysis indicates that understanding capital structure is essential, as it varies across industries, shaped by specific financial realities, operational structures, and strategic goals. By examining how firms in distinct sectors approach their financing, stakeholders can gain valuable insights into effective capital management strategies.

Impacts of Capital Structure on Business Performance

Capital structure refers to the way a corporation finances its overall operations and growth through various sources of funds, including debt and equity. The impacts of capital structure on business performance are profound and multifaceted, as the balance between debt and equity can significantly influence profitability, growth potential, and market valuation. Empirical findings suggest that companies with optimal capital structures tend to perform better financially than those that are over-leveraged or under-leveraged.

Research indicates that a carefully designed capital structure can enhance a firm’s profitability. For instance, firms that utilize leverage judiciously can amplify returns on equity and improve their overall return on investment. This leverage can provide a competitive edge, particularly in industries where capital is crucial for expansion and innovation. However, excessive debt can lead to financial distress, which adversely affects performance metrics and ultimately hampers growth prospects.

Furthermore, the impact of capital structure on market valuation is significant. The Modigliani-Miller theorem posits that, under certain conditions, the value of a company is unaffected by its capital structure; however, real-world conditions such as taxes, bankruptcy costs, and asymmetric information challenge this theory. Case studies reveal that firms with a well-balanced approach to capital structure often enjoy higher market valuations, demonstrating how investor perception is tied to the financial strategy of the company.

Decisions regarding capital structure can thus be the difference between success and failure for businesses. Companies that carefully assess and optimize their mix of debt and equity finance can enhance their financial flexibility, allowing them to respond better to market changes and invest in growth opportunities. In contrast, neglecting the implications of capital structure may result in reduced performance, illustrating the critical nature of this foundational aspect of financial strategy.

Frequently Asked Questions (FAQs)

Understanding capital structure is crucial for companies as it directly impacts their financial performance and overall strategy. Here, we address some common questions regarding capital structure to provide clarity on its significance and nuances.

What is capital structure optimization?

Capital structure optimization refers to the process of determining the most effective mix of debt and equity financing for a company. The goal is to minimize the cost of capital while maximizing company value. Factors such as market conditions, interest rates, and company risk profile must be considered while optimizing capital structure. Companies often seek a balance that allows them to leverage the benefits of debt financing without exposing themselves to excessive financial risk.

How does capital structure affect financial distress?

The relationship between capital structure and financial distress is critical. A company with a high level of debt relative to its equity may face challenges during economic downturns or periods of poor cash flow. In such cases, the burdensome debt obligations can lead to liquidity issues and, ultimately, insolvency. Conversely, a well-balanced capital structure can provide a financial cushion, enabling companies to navigate difficult times effectively.

What are the effects of capital structure on risk and return?

Capital structure plays a pivotal role in shaping a company’s risk and return profile. A higher proportion of debt in the capital structure often translates to higher financial risk due to fixed interest payments. However, it can also enhance returns during profitable periods. On the other hand, a more equity-heavy structure may be perceived as lower risk but might lead to diluted earnings per share. Thus, understanding the nuances of risk and return in relation to capital structure is essential for informed decision-making.

How does debt influence a company’s profitability?

Debt can significantly affect a company’s profitability, both positively and negatively. When used strategically, borrowing allows businesses to access additional capital for expansion, research, or acquisitions without diluting ownership. The interest on debt is often tax-deductible, which further enhances net income. However, too much borrowing can lead to higher interest obligations, reducing net profit margins and increasing the risk of financial distress. The key is maintaining a healthy leverage ratio—enough to stimulate growth but not so high that it jeopardizes financial stability during economic slowdowns.

Why is the cost of capital important in business decision-making?

The cost of capital is a vital benchmark that determines whether an investment or project will generate sufficient returns. It represents the minimum rate of return that investors and lenders expect from providing funds to a company. When the expected return from a project exceeds this cost, it adds value to the business; otherwise, it erodes shareholder wealth. Understanding the cost of capital helps management prioritize profitable ventures, optimize financing choices, and maintain a balance between risk and return. Companies with a lower cost of capital generally enjoy greater flexibility in strategic planning and long-term growth.

What role does financial leverage play in business growth?

Financial leverage refers to the use of borrowed funds to increase potential returns on investment. It allows businesses to undertake larger projects and expand operations beyond what internal financing alone could support. When managed carefully, leverage magnifies earnings and enhances shareholder value. However, it also amplifies losses during downturns, as interest and principal payments remain fixed regardless of revenue fluctuations. Successful companies continuously monitor their leverage ratios, ensuring that borrowed funds are used efficiently to generate sustainable growth and protect against volatility in market conditions.

How can a company reduce its financial risk?

A company can reduce financial risk by maintaining a balanced mix of debt and equity, managing cash flow efficiently, and avoiding over-reliance on borrowed funds. Building strong reserves and diversifying income streams help cushion against unexpected downturns. Additionally, refinancing high-interest loans, negotiating better credit terms, and adopting hedging strategies against currency or interest rate fluctuations can further protect profitability. Effective financial planning and consistent monitoring of leverage ratios ensure that a business remains stable even during market volatility.

What factors determine a firm’s financing decisions?

Several factors influence how a firm decides to finance its operations, including market conditions, industry standards, tax policies, business growth potential, and the cost of raising funds. Companies in stable industries may prefer debt due to predictable cash flows, while high-growth firms often rely more on equity to maintain flexibility. Management also considers investor expectations, interest rate trends, and regulatory requirements before making financing choices. The ultimate goal is to choose a funding mix that supports expansion while minimizing overall risk and cost.

Why do investors analyze a company’s debt-to-equity ratio?

Investors closely examine the debt-to-equity ratio because it reveals how a company balances borrowed funds with shareholders’ capital. A moderate ratio often indicates financial discipline and efficient use of leverage, suggesting that the business can manage debt responsibly while generating strong returns. Conversely, a very high ratio may signal excessive risk, as large debt obligations can strain cash flow during economic downturns. By evaluating this metric, investors gain insights into the company’s long-term solvency, profitability potential, and ability to sustain growth.

How does financial planning influence a company’s long-term growth?

Effective financial planning plays a decisive role in sustaining long-term growth by aligning resources, investments, and funding strategies with organizational goals. Through careful forecasting and budgeting, management can anticipate future capital needs, identify profitable investment opportunities, and avoid liquidity shortages. A well-planned financial framework ensures that funds are allocated efficiently between debt repayment, expansion projects, and shareholder returns. Moreover, continuous review of financial performance enables timely adjustments to adapt to market shifts, minimize risk exposure, and maintain a healthy balance between profitability and stability.

By addressing these frequently asked questions, we hope to underscore the importance of capital structure in formulating effective financial strategies. A thoughtful approach to capital structure can empower businesses to meet their long-term objectives while managing risks effectively.

Discover more from HUMANITYUAPD

Subscribe to get the latest posts sent to your email.