Tariffs and Quotas: 5 Powerful Facts You Must Know

Understanding Tariffs and Quotas

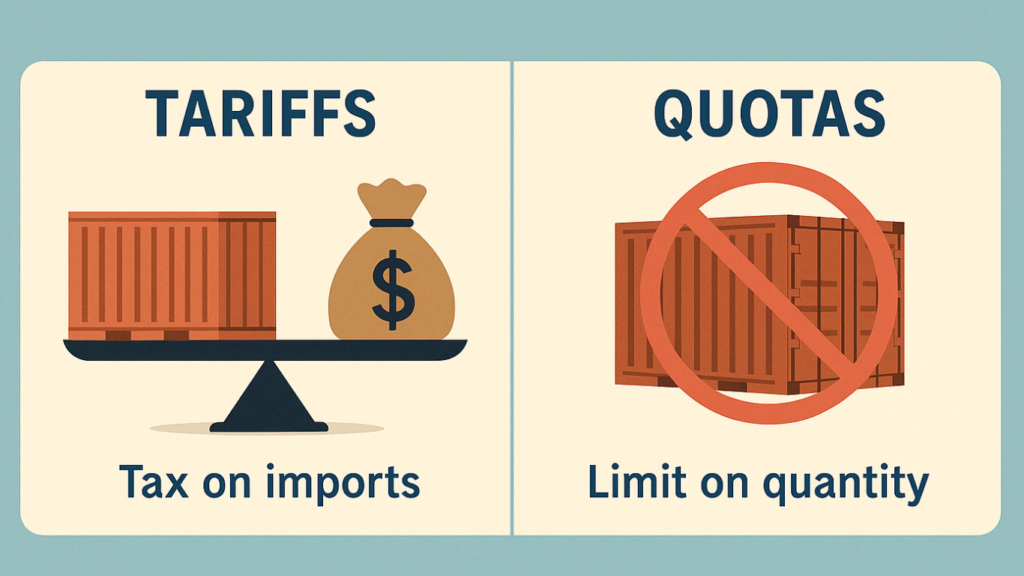

Tariffs and quotas are essential instruments in the realm of international trade, serving as regulatory measures that governments employ to influence the import and export of goods. A tariff is essentially a tax levied on imported goods, which raises the total cost of these products for consumers. This financial burden can deter imports and promote domestic industries by making local goods more competitive. Different types of tariffs exist, including specific tariffs, which are based on a fixed fee per unit, and ad valorem tariffs, calculated as a percentage of the total value of the goods imported.

On the other hand, quotas impose a physical limitation on the quantity of a specific product that can be imported into a country over a defined period. By restricting the supply of foreign goods, quotas serve to protect domestic producers from international competition, enabling them to maintain market share and pricing power. While tariffs generate revenue for the government, quotas, in contrast, do not contribute to public finances but do serve strategic economic interests.

Both tariffs and quotas have significant implications for trade balances. By altering the volume and cost of imports, they influence domestic production and consumption patterns. For instance, when tariffs increase, imports typically decline, which can lead to an improved trade balance if domestic production rises to fill the gap. Conversely, quotas may lead to shortages or increased prices for consumers if domestic production is unable to meet demand. Consequently, the use of tariffs and quotas requires careful consideration, as their implementation not only affects the economy but also has wider implications for international relations, prompting negotiations and retaliatory measures from other trading partners.

➡️ Table of Contents ⬇️

The Economics Behind Tariffs

Tariffs are a form of tax imposed on imported goods, primarily aimed at influencing international trade dynamics. Economically, tariffs serve multiple purposes, one of which is the protection of domestic industries. By levying taxes on foreign products, domestic producers can gain a competitive edge, as imported goods become more expensive compared to local offerings. This protective measure can help nascent industries or those struggling against established foreign competitors to flourish, ultimately strengthening the country’s economy.

Furthermore, tariffs serve as a mechanism for generating government revenue. The income obtained from these taxes can be significant, especially for countries that have a high volume of imports. Governments can utilize this revenue for various public expenditures, such as infrastructure, education, and healthcare. In addition to bolstering domestic industries and funding public services, tariffs can also act as a tool for negotiating trade agreements. Countries may agree to reduce tariffs in specific sectors for mutual benefit in other areas of trade.

Tariffs also significantly influence consumer behavior. Higher prices on imported goods can prompt consumers to shift their purchasing habits towards domestically produced alternatives. While this behavior may boost local economic activity, it can also lead to increased prices for consumers. In markets where domestically produced goods do not meet the same standards of quality or variety as their imported counterparts, consumers may face limited choices. Thus, while tariffs can protect domestic industries and generate revenue, they can also create economic distortions in the marketplace.

In summary, the economic principles justifying the implementation of tariffs encompass both protective and revenue-generating aspects. While they serve essential functions in regulating trade, it is crucial to consider their broader implications on consumer behavior and market dynamics.

Types of Tariffs

Tariffs serve as paramount tools for regulating international trade, imposing specific fees on imported goods. There are several primary types of tariffs employed by nations, each with distinct characteristics and applications that influence trade dynamics.

One of the most straightforward forms is the specific tariff. This type entails a fixed monetary amount charged per unit of imported goods. For example, if a country levies a specific tariff of $10 on every imported pair of shoes, regardless of the shoe’s price, the tariff remains unchanged as long as the quantity exceeds one pair. Such tariffs are commonly used in instances where nations seek to protect their domestic industries from foreign competition by making imported goods more expensive.

The second notable type is the ad valorem tariff, which is calculated as a percentage of the total value of the imported item. For instance, if an ad valorem tariff of 20% is imposed on a car valued at $20,000, the tariff would amount to $4,000. This type of tariff allows for flexibility in response to price fluctuations of the imported goods. Ad valorem tariffs are frequently applied to luxury items where the aim is to increase revenue while regulating market access.

Lastly, the compound tariff combines the characteristics of both specific and ad valorem tariffs. It entails a fixed fee and a variable percentage, thereby adjusting the overall cost based on the quantity and value of the goods. For instance, a compound tariff might include $5 per unit plus 10% of the value. This method effectively balances the need for protection of local industries while also ensuring some level of revenue generation for the government.

Understanding these different types of tariffs assists in comprehending their significant impact on global trade and the strategies countries utilize to navigate international markets.

The Role of Quotas in International Trade

Quotas are critical instruments in international trade that serve to limit the quantity of goods that can be imported into a country. Their primary purpose is to protect domestic industries from foreign competition by controlling the amount of specific goods that can enter a market. As a trade regulation tool, quotas can help stabilize prices and provide a buffer for local producers, allowing them to compete more effectively against foreign imports.

Import quotas can be categorized into two main types: absolute quotas and tariff-rate quotas. Absolute quotas impose a strict limit on the quantity of a certain product that can be imported during a specified timeframe. Once this limit is reached, additional imports are prohibited, which can significantly impact the availability and pricing of that product in the domestic market. Conversely, tariff-rate quotas allow for a certain quantity of goods to be imported at a lower tariff rate, while imports beyond that threshold are subjected to a higher tariff. This system not only manages import volumes but also encourages countries to regulate trade in a way that aligns with their economic objectives.

Quotas can be beneficial in safeguarding emerging industries or sectors that may not yet be competitive on a global scale. By limiting the influx of foreign goods, these regulations enable domestic producers to refine their offerings and enhance their market presence. However, it is essential to consider that while quotas may protect local industries, they can also lead to higher prices for consumers and potential retaliatory measures from trading partners. Ultimately, the implementation of quotas must balance the interests of domestic industries with the broader implications for international trade relations.

Benefits and Drawbacks of Tariffs and Quotas

The implementation of tariffs and quotas serves as a strategic approach for countries to regulate trade and protect their domestic markets. Among the benefits of tariffs is the protection they afford local industries from foreign competition. By imposing tariffs on imported goods, governments can make these products more expensive, thereby encouraging consumers to opt for domestically produced alternatives. This protective measure can lead to a reduction in trade deficits as local businesses thrive, ultimately contributing to increased domestic employment opportunities. Moreover, as local industries expand, they may experience economies of scale, resulting in more competitive pricing and potentially contributing positively to a nation’s economy.

However, tariffs and quotas are not without their drawbacks. One significant concern is the higher consumer prices that can result from increased tariffs. When foreign products become more expensive, consumers may find themselves paying more for goods that were previously more affordable. This price inflation can disproportionately affect low-income households, which spend a larger proportion of their income on consumables. Additionally, the implementation of trade barriers can lead to retaliation from other countries, resulting in an escalation of trade wars. Such retaliatory measures may not only harm the industries that tariffs were intended to protect but can also disrupt international trade relationships, potentially leading to longer-term economic ramifications.

Furthermore, while tariffs aim to foster domestic growth, they risk entrenching inefficiencies within local industries. Protected from foreign competition, domestic producers may lack the incentive to innovate or improve their products, leading to stagnation. Similarly, quotas can restrict supply and limit consumer choice, preventing them from accessing the best products available in the global market. It is critical for policymakers to weigh these benefits and drawbacks carefully to strike a balance that supports domestic needs while fostering healthy international trade relations.

⬇️ Subscribe to Stay Connected With HUMANITYUAPD. Completely Free. ⬇️

Impact on Consumers and Businesses

Tariffs and quotas serve as vital instruments in influencing the landscape of international trade, affecting both consumers and businesses significantly. By imposing tariffs, which are taxes on imported goods, governments can increase the cost of foreign products. This action often leads to higher retail prices for consumers who wish to purchase imported items. Consequently, this can compel consumers to gravitate towards domestic alternatives, inadvertently boosting local businesses while potentially limiting their choices. On the other hand, this protective measure can result in inflation, as increased prices may not always incentivize competitive pricing among domestic suppliers.

Quotas, comparatively, impose limits on the quantity of goods that can be imported. This restriction results in reduced supply levels for foreign products in the market. As a result, consumers may encounter scarcity or higher prices for the affected goods. From the perspective of domestic producers, quotas can allow for a more secure market position, as they create an environment where local manufacturers do not have to contend with overwhelming competition from abroad. However, this reduction in competition can stifle innovation and degrade product quality over time, as domestic firms may lack the impetus to improve when their market position is effectively safeguarded.

While many consumers may perceive tariffs and quotas as protective measures for local jobs and industries, the implications can vary widely. For example, while such regulations can help in promoting certain sectors, they may also lead to economic inefficiencies, prompting reduced consumer welfare. Conversely, businesses reliant on imported materials or products can suffer increased operational costs, impacting their market viability. Thus, understanding the intricacies of tariffs and quotas is crucial for assessing their comprehensive impact across the economic spectrum, underscoring the intricate balance between protectionism and consumer choice.

Global Trade Policy and No Tariff Zones

In recent years, there has been a notable shift in global trade policy towards reducing tariffs and establishing no-tariff zones. These initiatives are often manifest in the formation of free trade agreements (FTAs) which aim to stimulate economic growth by minimizing trade barriers between participating countries. FTAs promote a more liberal trading environment by eliminating tariffs, thereby enhancing market access and creating a more competitive landscape for businesses.

The establishment of no-tariff zones reflects a strategic approach to fostering international cooperation and economic integration. Countries involved in these agreements often benefit from increased trade volumes and economic collaboration, leading to an overall boost in productivity. Moreover, free trade agreements serve as a platform for nations to enhance their diplomatic relations, as they signify a commitment to mutual economic interests, fostering goodwill and stability among participating states.

One of the significant implications of reducing tariffs and promoting no-tariff zones is the potential for increased foreign direct investment (FDI). When tariffs are diminished, it lowers the cost of doing business for foreign investors, thus encouraging them to enter new markets. This influx of FDI can lead to job creation, technological transfer, and improved standards of living in host countries, thereby contributing positively to local economies.

However, the move towards no-tariff zones is not without its challenges. For instance, countries that are heavily reliant on tariff revenues may experience fiscal constraints as trade barriers are reduced. Additionally, there may be concerns regarding the potential for trade imbalances and the impact of competition on local industries that could struggle against larger foreign firms without protective tariffs in place.

Ultimately, the evolution of global trade policy towards no-tariff zones presents a transformative opportunity for economic growth and enhanced international cooperation, provided that the associated challenges are effectively managed to ensure a fair and equitable trading environment.

Recent Developments in Tariff and Quota Regulations

In recent years, the landscape of tariffs and quotas has evolved significantly, reflecting shifts in global trade dynamics and economic policies. Various nations have amended their tariff and quota regulations in response to both domestic economic conditions and international market forces. For instance, the United States and China, two of the world’s largest economies, have been at the forefront of tariff disputes. The trade war initiated between the two countries in 2018 led to the imposition of substantial tariffs on hundreds of billions of dollars’ worth of goods. Although some tariffs have been revised or removed since then, their effects are still observable in both markets, extending beyond their borders.

Additionally, the emergence of free trade agreements (FTAs) has been a prominent factor influencing tariff policies. Agreements such as the United States-Mexico-Canada Agreement (USMCA) have led to reduced tariff rates and new quota arrangements, fostering enhanced trade among the member nations. As trade agreements evolve, they tend to incorporate more advanced trade rules that affect underlying tariff structures, further complicating the regulation landscape.

Moreover, the global economic impact of the COVID-19 pandemic has prompted countries to reassess their trade strategies. Many nations have turned to protectionist measures, adjusting tariffs and quotas to safeguard domestic industries. Such actions can potentially stifle global trade growth, igniting further deliberations among countries to ensure trade compliance and economic stability.

Overall, recent developments indicate a trend towards increased scrutiny of tariff and quota regulations in response to geopolitical tensions, pandemic-related disruptions, and the shifting priorities of national economies. It is essential for businesses and policymakers to stay informed about these changes, as they could significantly influence trade practices and economic outcomes worldwide.

Frequently Asked Questions (FAQs) on Tariffs and Quotas

Trade regulation is a critical component of international commerce, and tariffs and quotas play significant roles in shaping economic landscapes. This section addresses common inquiries surrounding these economic tools to help clarify misunderstandings and provide straightforward information.

What are tariffs?

Tariffs are taxes imposed by a government on imported goods. Their primary purpose is to increase the cost of foreign products, making domestic products more competitive in the market. By raising the price of imports, tariffs can protect local industries and workers, promote local economic growth, and generate revenue for the government.

What are quotas?

Quotas are limitations set by governments on the quantity of specific goods that can be imported or exported during a specified period. By restricting the supply of imports, quotas aim to stabilize the domestic market and help local producers maintain a steady share of the market. This restriction can lead to higher prices for consumers and can limit the variety of goods available in the market.

How effective are tariffs and quotas?

The effectiveness of tariffs and quotas is a topic of debate among economists. Proponents argue that these measures protect local industries and jobs, while opponents claim they can lead to higher consumer prices and retaliatory measures from trading partners. The impact of tariffs and quotas on trade volume can vary significantly depending on the specific goods affected and the overall economic context.

How do tariffs and quotas affect everyday life?

Individuals may not always notice the direct impact of tariffs and quotas in their daily lives, but these trade regulations can influence the prices of imported goods and the availability of certain products. Higher costs for imports can lead to increased prices for consumers, affecting purchasing power and lifestyle choices. Moreover, certain sectors may benefit from reduced competition, which can lead to job stability in those industries.

Why do countries implement tariffs and quotas?

Countries use tariffs and quotas to protect domestic industries from foreign competition, safeguard national interests, and support economic development. These measures can help local businesses grow by giving them a competitive edge against cheaper or subsidized foreign imports.

What is the difference between tariffs and quotas?

Tariffs involve adding taxes to imported goods, increasing their cost, while quotas limit the quantity of goods that can be imported. Both are trade barriers, but tariffs raise prices, whereas quotas control supply. Governments may use either depending on their economic or political strategy.

Can tariffs and quotas lead to trade wars?

Yes, excessive or aggressive use of tariffs and quotas can provoke retaliation from trading partners, leading to trade wars. These conflicts can disrupt global supply chains, raise prices, and negatively impact economic growth for all countries involved.

Are tariffs and quotas legal under international trade rules?

Tariffs and quotas are permitted under World Trade Organization (WTO) rules, but there are restrictions. Quotas are generally limited to specific exceptions like safeguarding domestic industries, while tariffs must comply with agreed limits. Violations can lead to disputes between countries.

Addressing these frequently asked questions highlights the integral role tariffs and quotas play in shaping international trade dynamics and their effects on national economies and everyday consumers.

Discover more from HUMANITYUAPD

Subscribe to get the latest posts sent to your email.