50/30/20 Budgeting Rule: Smart Money Strategy

Understanding the 50/30/20 Rule

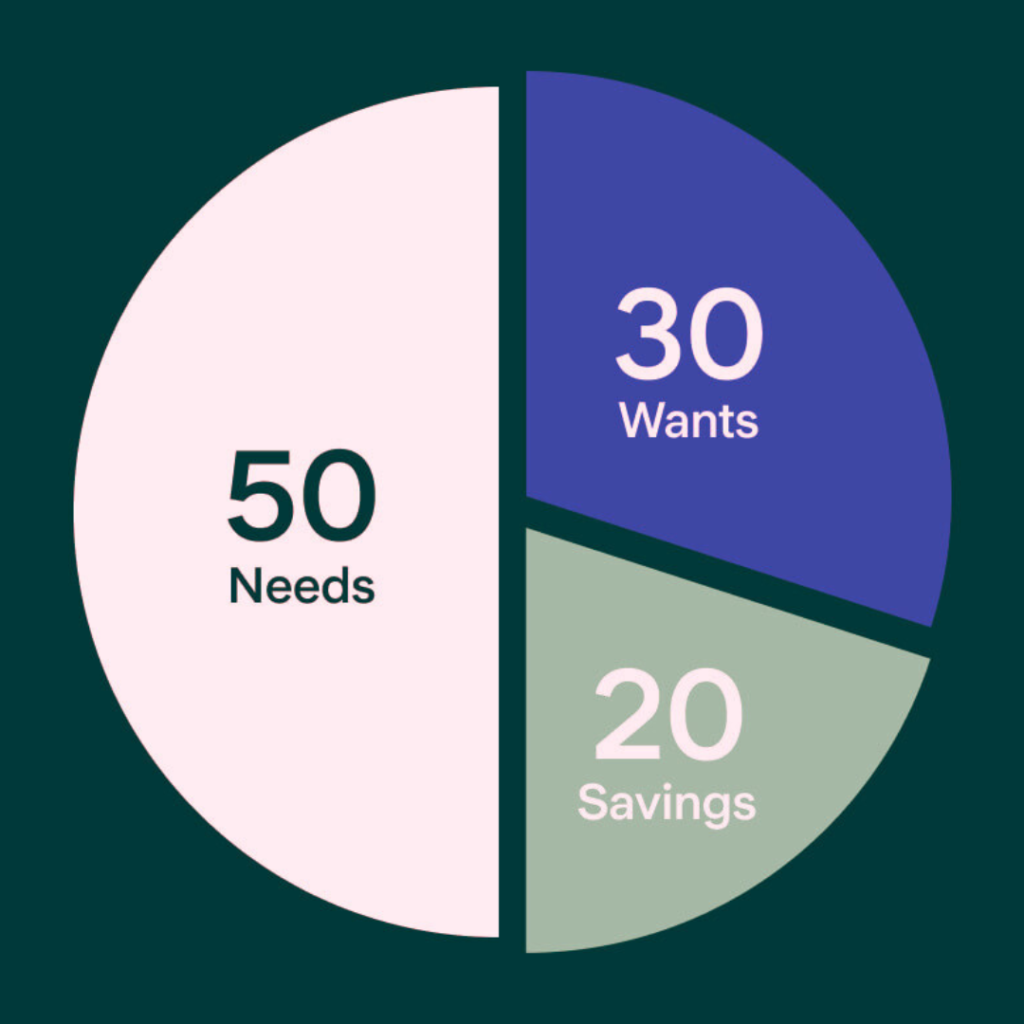

The 50/30/20 budgeting rule is a straightforward financial guideline designed to help individuals effectively manage their money and achieve financial stability. This rule segments income into three essential categories: needs, wants, and savings or debt repayment. According to this philosophy, 50% of an individual’s after-tax income should be allocated for needs, such as housing, transportation, and basic groceries. The next 30% can be used for wants—discretionary spending that enhances one’s lifestyle, such as dining out and entertainment.

Sign up for HUMANITYUAPD

Finally, the remaining 20% is reserved for savings or debt repayment, fostering a balance between immediate enjoyment and long-term financial health. By adopting this structure, individuals can streamline their spending while ensuring that they account for both current expenses and future financial obligations.

Budgeting is a critical aspect of personal finance management, as it provides a clear financial roadmap. Understanding one’s spending habits and categorizing expenses allows for conscious decision-making regarding money. The 50/30/20 rule aids in this process by offering a simple formula that can be tailored to individual financial situations. It encourages discipline by setting clear limits on different types of spending. This approach can be particularly useful for those who may find traditional budgeting techniques overly complex or restrictive.

The overarching goal of the 50/30/20 rule is to promote healthy financial habits that can lead to improved financial security. By maintaining an awareness of one’s financial inflows and outflows, individuals can make informed choices that enhance their economic well-being. This rule serves as a guiding principle for individuals at all stages of life, helping them navigate the complexities of personal finance with greater confidence and clarity.

➡️ Table of Contents ⬇️

The Science of Budgeting: Why It Matters

Budgeting is a fundamental element of personal finance that not only helps individuals manage their spending but also significantly impacts their overall well-being. Research in psychology and economics highlights that having a structured budget enables individuals to enhance their financial decision-making, leading to better long-term outcomes. A study conducted by researchers at the University of Southern California found that people who adhere to a budget report lower levels of financial stress. This alleviation of anxiety is largely attributed to the clarity and control that budgeting provides over one’s financial landscape.

Moreover, cognitive biases play a crucial role in shaping how individuals perceive and make financial decisions. For instance, the present bias leads individuals to prioritize immediate gratification over long-term financial goals, often resulting in poor spending choices. In contrast, the practice of budgeting encourages foresight by allocating resources intentionally, effectively countering these biases. When individuals establish a budget, they engage in a process of self-reflection and evaluation, which can motivate them to stick to their financial goals.

Furthermore, behavioral economists have identified the concept of mental accounting, where individuals compartmentalize their finances into different categories, which can often lead to irrational financial behaviors. A structured budget helps mitigate the effects of mental accounting by promoting a holistic view of personal finance. This clear framework not only simplifies tracking expenses but also fosters accountability and discipline, which are essential for effective money management. Thus, the psychological advantages of budgeting extend beyond mere numbers and into the realm of emotional health, showcasing its indispensable role in achieving financial stability.

Incorporating these insights into the everyday practice of budgeting can catalyze significant changes in individuals’ financial behaviors, paving the way for a more secure financial future.

Breaking Down the 50/30/20 Allocation

The 50/30/20 budgeting rule offers a straightforward framework for managing personal finances by categorizing expenses into three primary allocations. According to this rule, individuals should allocate 50% of their after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. This balanced approach helps in maintaining financial health while ensuring that essentials and discretionary spending are adequately addressed.

In the needs category, which takes up half of your monthly budget, you will find essential expenses required for basic survival and functioning. This typically includes housing costs such as rent or mortgage payments, utilities, groceries, transportation, insurance, and healthcare. It is critical to accurately identify these necessities as they directly impact your quality of life. For example, while a gym membership may promote health, it does not qualify as a need; rather, it is a desire that falls into the next category.

The wants category constitutes 30% of your budget and allows for more flexibility and enjoyment. This encompasses discretionary expenses that enhance one’s lifestyle but are not essential for basic living. Examples may include dining out, entertainment subscriptions, luxury items, and travel. Allocating a reasonable portion of your income to wants can foster a sense of fulfillment and happiness, as long as it does not compromise financial stability.

Lastly, the 20% allocation focuses on savings and debt repayment, thereby laying the groundwork for financial security. It is crucial to prioritize building an emergency fund, saving for retirement, and making extra payments on debts to reduce financial burdens. This approach not only promotes personal financial growth but also instills discipline that can be beneficial for long-term financial health.

How to Implement the 50/30/20 Rule

Implementing the 50/30/20 budgeting rule can serve as a structured approach to managing personal finances, allowing individuals to allocate their income effectively. The first step in this process is to track your expenses meticulously. Begin by documenting all of your expenditures over a month, categorizing them into needs, wants, and savings or debt repayment. This can be done using budgeting apps or spreadsheets that simplify the tracking and categorization, thereby providing a clearer picture of where your money is going.

Once you have a comprehensive list of your monthly expenses, it becomes easier to analyze them against the 50/30/20 framework. According to this rule, 50% of your income should go toward essential needs—such as housing, utilities, groceries, and healthcare. The next 30% is intended for wants, which can include dining out, entertainment, and hobbies. Finally, the remaining 20% should be dedicated to savings, investments, or debt repayment.

After categorizing your expenses, examine areas where adjustments can be made to align your spending with the established percentages. If necessary, you may need to reduce discretionary spending to meet your financial goals. For example, if your wants currently exceed 30%, create a plan to decrease that portion gradually by finding less expensive alternatives or cutting certain non-essential items.

Setting clear, achievable financial goals is also crucial when implementing the 50/30/20 rule. These goals should align with the categories in your budget. Whether it’s saving for a vacation, building an emergency fund, or paying down debt, having specific targets can motivate you to adhere to your budget more strictly.

In conclusion, the 50/30/20 budgeting rule can be effectively implemented through meticulous expense tracking, thoughtful categorization, spending adjustments, and goal-setting. Utilizing tools like budgeting apps or spreadsheets can greatly enhance the process, making it easier to monitor progress and maintain financial discipline.

Common Challenges and How to Overcome Them

Implementing the 50/30/20 budgeting rule can present several challenges that may hinder an individual’s ability to manage their finances effectively. One common obstacle is encountering unexpected expenses. These may arise from car repairs, medical bills, or emergency situations that disrupt even the best-laid plans. To address this challenge, it is advisable to establish an emergency fund that serves as a financial cushion. Experts recommend saving at least three to six months’ worth of living expenses to mitigate the impact of unforeseen costs, ensuring that these expenses do not derail the overall budget.

Another challenge is emotional spending, which is often driven by stress, boredom, or social pressures. Individuals may find themselves deviating from the budget as a means of coping with negative emotions or seeking instant gratification. To combat emotional spending, it is essential to identify triggers and develop healthier coping mechanisms. Keeping a detailed journal of spending can help individuals recognize patterns and establish more mindful purchasing habits. Additionally, introducing alternative activities that do not involve spending—such as exercise, reading, or engaging in hobbies—can provide fulfillment without impacting the budget.

Potential difficulties may also arise from the complexities of needs versus wants. Individuals might struggle with categorizing expenses accurately, leading to misallocation of funds. To counter this, one effective strategy is to refine the budgeting categories based on personal values and priorities. This approach encourages individuals to make intentional spending choices that align with their goals. Furthermore, regular monitoring and reviewing of the budget is crucial; this allows for adjustments that accommodate changes in income or lifestyle while maintaining adherence to the 50/30/20 guideline. By proactively addressing these challenges, individuals can enhance their budgeting success and ultimately achieve a more stable financial future.

Adapting the 50/30/20 Rule to Your Lifestyle

The 50/30/20 budgeting rule is a widely recognized framework designed to promote effective personal finance management. However, this model is not one-size-fits-all; it requires adaptation to suit varying life situations, including those of students, parents, and retirees. By tailoring the 50/30/20 rule to one’s specific context, individuals can ensure they are budgeting effectively while still adhering to sound financial principles.

For students, financial realities often differ significantly from those of a traditional job holder. Many students may find that living expenses and educational costs necessitate a higher percentage of their budget being allocated towards needs or debts, such as student loans. In this case, it may be prudent to adjust the 50/30/20 split to 60/30/10, where needs account for 60%. This allows students to focus on essential expenses while still making room for discretionary spending and savings, albeit at a reduced rate.

Parents face unique challenges that can also modify the 50/30/20 rule. Childcare, education costs, and healthcare can absorb a significant portion of household income. It may be beneficial for parents to adopt a 70/20/10 structure, prioritizing needs at 70% to ensure the family’s basic necessities are met while still directing some funds towards savings and fun activities for children. This approach fosters a balanced financial life while accommodating the additional responsibilities of parenthood.

Individuals nearing retirement may also find the need to revisit the 50/30/20 allocation. As income typically stabilizes or declines at this stage, a more conservative approach such as 40/40/20 could be effective. This adjustment allows a larger focus on needs, essential for living on a fixed income, while still providing for savings and discretionary spending aimed at enhancing quality of life in retirement.

The Role of Emergency Funds and Investments

Within the realm of personal finance, the establishment of an emergency fund serves as a vital component of the 50/30/20 budgeting rule. This guideline suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. An emergency fund, ideally amounting to three to six months’ worth of living expenses, falls under the savings category. This reserve acts as a financial buffer, preventing individuals from falling into debt during unexpected situations such as medical emergencies, job loss, or urgent home repairs. Thus, having an emergency fund not only fosters financial stability but also reinforces adherence to overall budgeting principles.

Investments, on the other hand, represent another crucial pillar within the 50/30/20 framework. While saving is essential, merely setting aside money may not yield considerable growth over time. Hence, investing becomes inherent in enhancing financial health, providing individuals with opportunities to grow their wealth and achieve long-term financial goals. Different investment strategies, including stocks, bonds, mutual funds, and real estate, offer varying degrees of risk and return. Individuals can adopt a diversified approach—balancing higher-risk investments with conservative options—to mitigate potential losses and enhance the overall safety of their financial portfolio.

As one aligns their investment strategy with the budgeting rule, it is critical to consider personal risk tolerance and financial objectives. This thoughtful blend of establishing an emergency fund and increments of investments not only fortifies one’s financial foundation but aligns well with the 50/30/20 philosophy, ensuring a balanced approach toward sustainable personal finance management. Ultimately, through disciplined saving, thoughtful investment, and prudent financial planning, individuals can navigate potential crises while paving the way for future prosperity.

Frequently Asked Questions (FAQs)

The 50/30/20 budgeting rule has gained popularity for its simplicity and effectiveness in managing personal finances. Here are some common questions regarding its application and flexibility.

Can I adjust my percentages?

Yes, the 50/30/20 rule is a flexible framework that can be adapted to suit individual financial situations. While the guideline suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment, personal circumstances may necessitate adjustments. For example, if you have high debt obligations or specific savings goals, it might be prudent to allocate additional funds towards those categories. The essence of this budgeting method is to provide a foundation from which individuals can build according to their unique financial landscapes.

What if my needs exceed 50%?

If your essential expenses, such as housing, utilities, and groceries, exceed 50% of your income, it is critical to reassess your budget. In such cases, identifying areas where you can reduce discretionary spending becomes essential. Consider reviewing your wants category and lifestyle choices that may be adjusted to accommodate higher needs. Additionally, seeking ways to increase your income through side jobs or career advancements could help balance your budget. The key is to maintain financial stability while addressing high necessity costs without neglecting savings and debt repayment.

Is this budgeting approach suitable for everyone?

While the 50/30/20 rule offers a clear guideline that many find beneficial, it may not be suitable for everyone. Individuals with significant financial obligations or those who are in the process of recovering from debt may require a more tailored approach. Similarly, those in varying regions or economic situations may find that their needs and wants diverge significantly from the prescribed ratios. It is advisable for individuals to evaluate their financial priorities and customize their budgeting approach to create a more effective, personalized strategy.

How does the 50/30/20 rule work with irregular income?

For individuals with fluctuating or irregular income, such as freelancers or commission-based workers, applying the 50/30/20 rule requires some adjustments. One approach is to base budget allocations on an average monthly income, calculated from past earnings. During high-earning months, setting aside a larger portion for savings and essential expenses can help cover lower-income periods. Creating a buffer or emergency fund can also provide stability, ensuring that necessary expenses are covered even when income varies.

Can I use this rule if I have significant debt?

Yes, but modifications may be necessary depending on the level of debt. If paying off high-interest debt is a priority, allocating more than 20% toward debt repayment can be beneficial. This may require reducing discretionary spending in the wants category to accelerate debt reduction. Once high-interest debts are managed, shifting focus back to savings and long-term financial goals can help maintain overall financial health. The key is to balance debt repayment with essential expenses and future financial security.

Conclusion: The Long-Term Benefits of the 50/30/20 Rule

Adopting the 50/30/20 budgeting rule can significantly enhance one’s financial well-being over time. This method provides a structured approach to managing personal finances, promoting clarity in spending and saving habits. By allocating 50% of income to needs, 30% to wants, and 20% to savings or debt repayment, individuals can foster a balanced financial life that withstands economic fluctuations and personal challenges.

One of the primary advantages of the 50/30/20 rule is its inherent simplicity. This straightforward allocation empowers individuals to make informed decisions about their finances without overwhelming complexity. As a result, it encourages consistency in budgeting, which is crucial for long-term financial stability. Regular adherence to this rule can cultivate healthy spending habits, enabling individuals to differentiate between essential expenditures and non-essential luxuries.

Moreover, dedicating a portion of income to savings promotes a proactive mindset toward financial goals. This allocation not only builds an emergency fund, which provides a safety net during unforeseen circumstances, but also supports long-term aspirations such as retirement planning, investments, or major purchases. Over time, adhering to the 50/30/20 rule contributes to cumulative wealth, enhancing overall financial security.

Ultimately, implementing the 50/30/20 budgeting strategy transcends mere numbers. It empowers individuals to take control of their financial futures, promoting mindfulness in spending and a disciplined approach to saving. By encouraging financial accountability, this budgeting framework can lead to an improved quality of life as financial stress is reduced and the path to achieving personal financial goals becomes clearer. Embracing the 50/30/20 rule is not merely a matter of budgeting; it is a commitment to a more secure and fulfilling financial future.

Discover more from HUMANITYUAPD

Subscribe to get the latest posts sent to your email.