Mastering Your Finances with the 50/30/20 Rule

In the dynamic landscape of personal finance, it’s crucial to establish a solid framework for managing your money effectively. One popular and widely endorsed method is the 50/30/20 rule. In this blog post, we will delve into the intricacies of this rule, exploring its origins, principles, and practical applications to empower you on your journey to financial success.

Understanding the 50/30/20 Rule

A. The Basics:

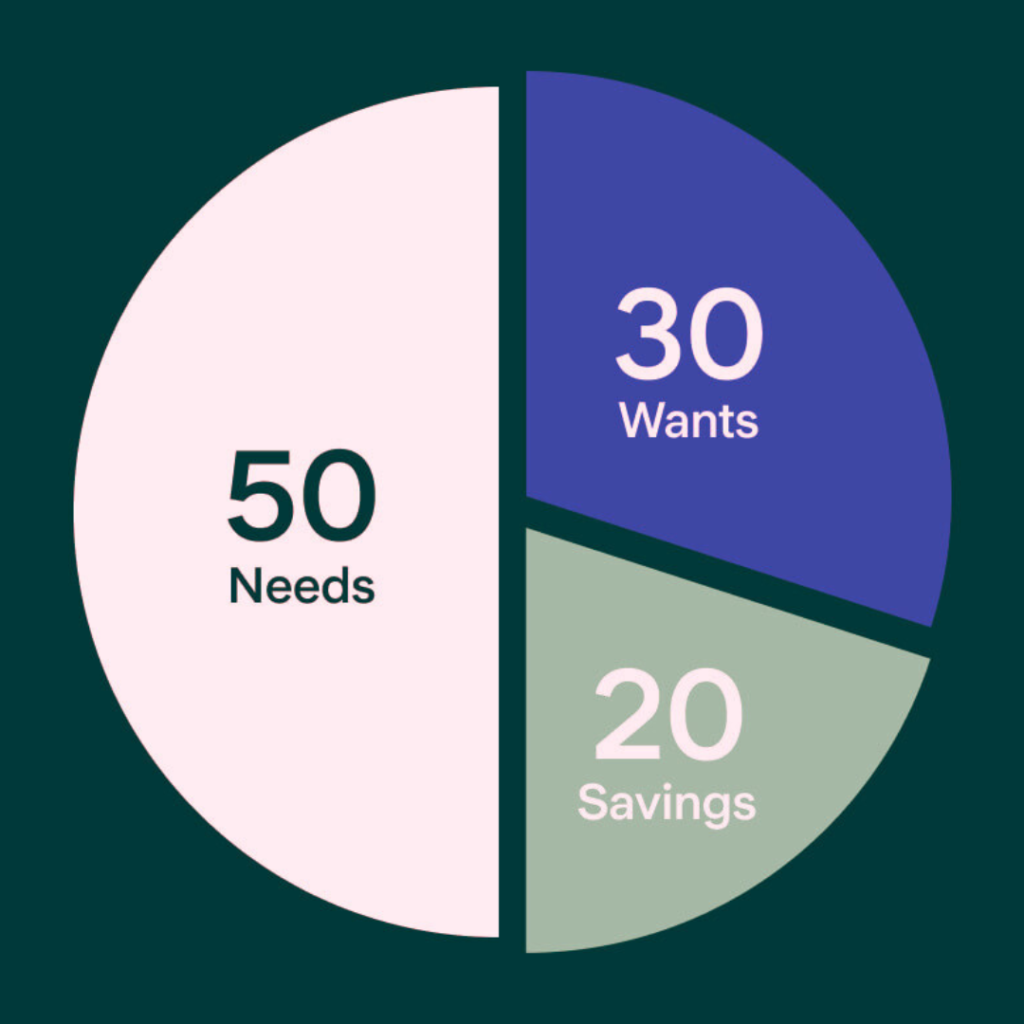

- Essence of Simplicity: At its core, the 50/30/20 rule simplifies budgeting by dividing your income into three distinct categories: needs, wants, and savings.

- 50% for Needs: Half of your income is earmarked for essential needs, encompassing housing, utilities, groceries, transportation, insurance, and minimum debt payments.

- 30% for Wants: This portion covers discretionary spending, including non-essential expenses like dining out, entertainment, subscriptions, and personal hobbies.

- 20% for Savings: The remaining 20% is dedicated to savings and debt repayment, fostering financial security and future wealth.

B. The Genesis:

- Authors’ Perspective: Originating from the book “All Your Worth: The Ultimate Lifetime Money Plan” by Elizabeth Warren and Amelia Warren Tyagi, the rule reflects their commitment to making financial management accessible to everyone.

- Universal Applicability: The rule’s universality lies in its adaptability to various income levels and financial goals, democratizing effective budgeting.

Implementing the 50/30/20 Rule

I. Assessing Your Income:

A. Calculate Your Total Income:

- Include All Sources: Start by tallying up all sources of income, including your primary salary, side hustles, freelance work, or any additional revenue streams.

- Consistency Matters: Consider the regularity and reliability of each income source to gauge your financial stability accurately.

B. Distinguish Gross from Net Income:

- Understanding Gross Income: Differentiate between your gross and net income to grasp the actual funds available for budgeting after deductions.

- Factoring in Deductions: Be aware of taxes, insurance premiums, and other deductions that impact your take-home pay.

II. Identifying Essential Needs:

A. Comprehensive Needs Assessment:

- Break Down Essential Expenses: Create a detailed list of your essential needs, including housing costs, utilities, groceries, transportation, insurance, and any minimum debt payments.

- Realistic Cost Estimates: Be realistic in estimating the costs associated with each essential need to avoid underestimation.

B. Prioritizing Needs:

- Urgency Matters: Prioritize essential needs based on urgency and importance, ensuring that critical expenses are addressed first.

- Allocate 50% of Income: Allocate 50% of your total income to cover these essential needs. Adjust the allocation if needed but strive to stay within the recommended range.

III. Allocating for Wants:

A. Identify Discretionary Spending Areas:

- Define Discretionary Expenses: Identify areas of discretionary spending such as dining out, entertainment, subscriptions, and personal hobbies.

- Set Realistic Limits: Establish reasonable limits within the 30% category to prevent overspending while still allowing for some lifestyle enjoyment.

B. Striking a Balance:

- Balance Enjoyment and Responsibility: Strive to strike a balance within the 30% allocation, ensuring that you enjoy life’s pleasures without compromising financial stability.

- Regularly Review Spending Habits: Periodically review and adjust your discretionary spending to align with your financial goals.

IV. Emphasizing Savings and Debt Repayment:

A. Building an Emergency Fund:

- Allocate for Savings: Dedicate a portion of the 20% to building an emergency fund, aiming for three to six months’ worth of living expenses.

- Consistent Contributions: Make consistent contributions to your emergency fund, treating it as a non-negotiable aspect of your financial plan.

B. Strategic Debt Repayment:

- Identify High-Interest Debts: Prioritize high-interest debts within the 20%, developing a strategic plan for timely and efficient debt repayment.

- Snowball or Avalanche Method: Choose a debt repayment method that suits your financial situation, whether it’s the snowball method (paying off smaller debts first) or the avalanche method (tackling high-interest debts first).

Overcoming Challenges and Adjusting the 50/30/20 Rule

I. Dealing with Irregular Income:

A. Creating Buffer Categories:

- Flexible Allocations: Allocate a portion of your budget to buffer categories, allowing for variations in income for those with irregular earnings.

- Emergency Fund Importance: Emphasize the significance of having a robust emergency fund to provide a financial cushion during lean periods.

B. Periodic Adjustments:

- Regular Review: Conduct regular reviews of your budget, adjusting allocations as needed to align with fluctuations in income.

- Adaptability: Embrace the flexibility of the 50/30/20 rule, understanding that periodic adjustments are a natural part of navigating irregular income.

II. Tackling High-Cost Living Areas:

A. Explore Cost-Cutting Measures:

- Strategic Living Choices: Consider lifestyle adjustments that align with your financial goals, such as downsizing or finding more affordable living arrangements.

- Community Insights: Seek insights from individuals living in high-cost areas, learning from their experiences and cost-cutting strategies.

B. Quality of Life Considerations:

- Balancing Act: Strike a balance between financial prudence and maintaining a reasonable quality of life, ensuring that cost-cutting measures are sustainable in the long run.

- Negotiation Skills: Develop negotiation skills for rent and other fixed expenses, exploring opportunities for cost reductions.

III. Addressing Unexpected Expenses:

A. Importance of Emergency Fund:

- Emergency Fund as a Safety Net: Reinforce the critical role of the emergency fund as a safety net for unexpected expenses, emphasizing the need to prioritize its growth.

- Periodic Fund Assessments: Regularly assess your emergency fund’s adequacy and make adjustments based on changes in living expenses or income.

B. Utilizing Windfalls Strategically:

- Windfall Planning: Develop a plan for windfalls, allocating a portion to the emergency fund and using the remainder for debt repayment or savings.

- Resisting Lifestyle Inflation: Avoid succumbing to lifestyle inflation when receiving unexpected funds, maintaining a focus on your financial goals.

IV. Adapting to Life Changes:

A. Life-Cycle Adjustments:

- Dynamic Nature of Life: Acknowledge that life is dynamic, and as circumstances change (e.g., marriage, parenthood, career shifts), your budget may require adjustments.

- Proactive Planning: Anticipate life changes and proactively plan for adjustments to your 50/30/20 allocations to accommodate new priorities.

B. Goal Reevaluation:

- Reviewing Financial Goals: Regularly review your financial goals, ensuring that they align with your current life stage and making necessary adjustments to your savings and debt repayment strategies.

- Flexibility in Goal Setting: Embrace the flexibility to modify your goals as needed, understanding that priorities may shift over time.

V. Seeking Professional Guidance:

A. Financial Advisor Consultation:

- Expert Insight: Consider consulting a financial advisor for personalized guidance, especially during major life changes or when facing complex financial situations.

- Budgeting Workshops: Attend budgeting workshops or seminars to enhance your financial literacy and gain insights into adapting the 50/30/20 rule to specific scenarios.

The Benefits of the 50/30/20 Rule

The 50/30/20 rule isn’t just a budgeting guideline; it’s a blueprint for financial success. In this segment, we will explore the myriad benefits that come with embracing the 50/30/20 rule. From fostering financial discipline to helping achieve long-term goals, this rule has the power to transform your relationship with money and pave the way to lasting financial freedom.

I. Financial Discipline:

A. Structured Spending Framework:

- Clear Allocations: The rule provides a straightforward framework, delineating specific percentages for needs, wants, and savings. This clarity fosters financial discipline by preventing ambiguity in spending decisions.

- Avoiding Impulse Purchases: Knowing that you have allocated funds for discretionary spending (wants) helps curb impulsive purchases, contributing to disciplined financial behavior.

II. Achieving Financial Goals:

A. Customizable for Goals:

- Alignment with Aspirations: The 50/30/20 rule is highly customizable, allowing individuals to align their budget with specific financial goals, whether it’s saving for a home, education, or retirement.

- Progress Tracking: Clear savings and debt repayment categories facilitate progress tracking, motivating individuals to stay on course toward achieving their financial objectives.

III. Stress Reduction:

A. Emergency Fund as a Safety Net:

- Financial Security: Allocating a portion of your budget to building an emergency fund provides a safety net, reducing financial stress when unexpected expenses arise.

- Peace of Mind: Knowing that you have funds set aside for unforeseen circumstances brings peace of mind, allowing you to navigate challenges without the anxiety of financial instability.

IV. Flexibility for Life Changes:

A. Adaptable to Life Transitions:

- Dynamic Nature: Life is dynamic, and the 50/30/20 rule’s adaptability accommodates changes in income, living situations, and personal circumstances.

- Easing Transitions: Whether getting married, having children, or experiencing career shifts, the rule allows for adjustments, making financial transitions smoother.

V. Simplicity for All Income Levels:

A. Universality and Accessibility:

- Accessible to Everyone: The simplicity of the 50/30/20 rule makes it accessible to individuals across various income levels and financial backgrounds.

- Inclusive Financial Planning: It democratizes financial planning, ensuring that everyone, regardless of financial literacy, can embark on a path toward financial wellness.

VI. Debt Repayment Acceleration:

A. Strategic Debt Tackling:

- Prioritizing High-Interest Debts: Allocating a dedicated portion of your budget to debt repayment allows for strategic tackling of high-interest debts, accelerating the journey toward debt-free living.

- Snowball or Avalanche Methods: The rule accommodates different debt repayment strategies, such as the snowball method (tackling smaller debts first) or the avalanche method (focusing on high-interest debts).

VII. Budgeting Simplicity:

A. Easy Monitoring and Adjustments:

- Monthly Review: The rule encourages regular monthly reviews, making it easy to monitor spending patterns and adjust allocations as needed.

- No Need for Complex Tools: Budgeting becomes a straightforward process without the need for intricate financial tools, promoting accessibility and ease of implementation.

VIII. Long-Term Wealth Building:

A. Savings as a Wealth Foundation:

- Building Wealth Over Time: Consistently allocating a portion of your budget to savings lays the foundation for long-term wealth building, providing financial security and options for the future.

- Investment Opportunities: As savings grow, individuals may explore investment opportunities, further enhancing their potential for wealth accumulation.

IX. Testimonials and Success Stories:

A. Real-World Validation:

- Anecdotal Evidence: Success stories and testimonials from individuals who have embraced the 50/30/20 rule underscore its effectiveness in transforming financial lives.

- Inspiration for Others: Hearing how others have overcome financial challenges and achieved stability through the rule can serve as inspiration for those on a similar journey.

Conclusion

In mastering your finances, the 50/30/20 rule emerges as a comprehensive and empowering tool. By understanding its foundations, implementing it in the face of challenges, and reaping its manifold benefits, you pave the way for financial success. Embrace the simplicity, flexibility, and long-term vision embedded in the 50/30/20 rule, and embark on a transformative journey toward financial freedom.

Disclaimer

The information provided in this blog post is for educational and informational purposes only. It is not intended as financial advice, and readers are encouraged to consult with a qualified financial advisor for personalized guidance based on their individual circumstances. The author and the platform are not responsible for any financial decisions made based on the information provided. Additionally, financial situations can vary, and the 50/30/20 rule may not be suitable for everyone. It is crucial to adapt financial strategies to individual needs and seek professional advice when necessary.

Subscribe Now for Exclusive Updates and Insights