PAN Number Not Valid Error – Fix It (6 Unique Steps)

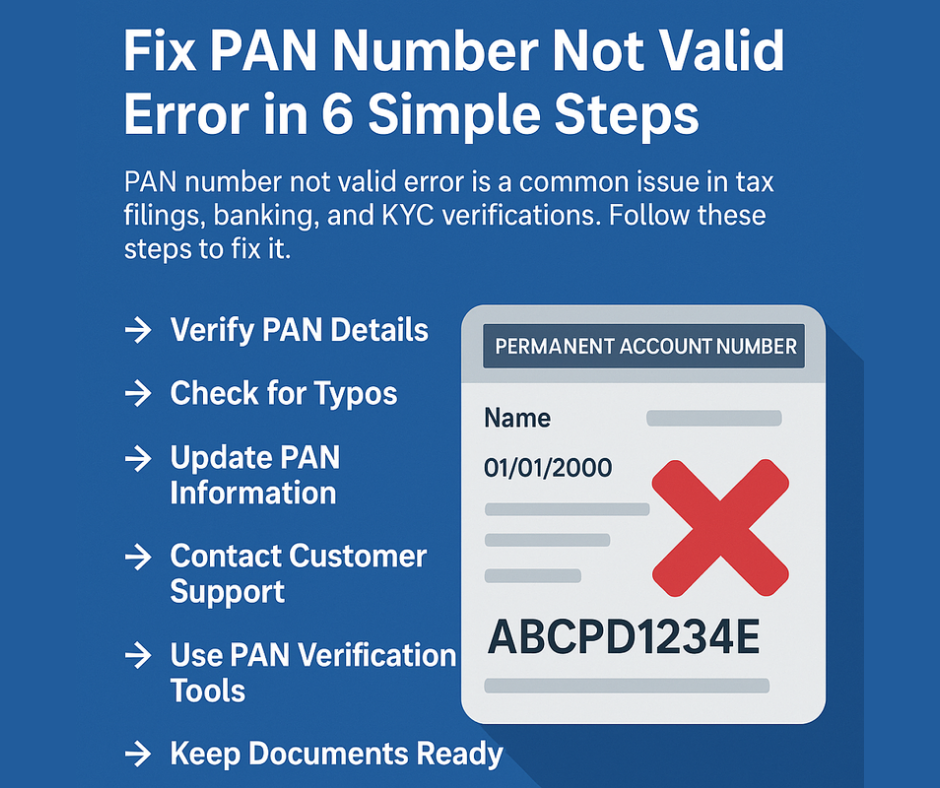

Fix PAN Number Not Valid Error in 6 Simple Steps

PAN number not valid error is one of the most common issues people face on the Income Tax portal, bank KYC systems, and financial apps. When your PAN details don’t match the official database, the system instantly blocks verification, stopping you from filing taxes, completing KYC, or accessing essential financial services. For many users, this error appears unexpectedly and creates confusion about whether the PAN is active or not.

The error usually occurs because of mismatched personal details like name, date of birth, Aadhaar information, or outdated PAN records. Even a minor spelling mistake or old KYC data can cause the system to reject your PAN. In some cases, the problem is not with your details at all but with temporary server issues on the Income Tax portal.

Keeping your PAN information accurate and updated is crucial because it is used for tax filing, online verification, opening bank accounts, investments, and government services. When this error appears, understanding the exact cause helps you fix it quickly and restore access to all your financial activities without delays.

➡️ Table of Contents ⬇️

Step 1: Verify Your PAN Details

When encountering a “PAN number not valid” error, the initial step to rectify this issue is to verify your Permanent Account Number (PAN) details. Accuracy is essential, as discrepancies between the records might lead to complications while accessing various financial services or filing taxes. The Government of India’s Income Tax Department provides a user-friendly online platform to assist individuals in confirming the authenticity of their PAN details.

To begin this verification process, visit the official website of the Income Tax Department. Once there, look for the option labeled “Verify PAN.” This tool allows you to check your PAN details against the records maintained by the department. It is essential to input accurate information for successful verification. Enter your PAN, along with your name, date of birth, and any other requisite details to proceed.

After submitting the information, examine the displayed results carefully. Ideally, the details shown should match those provided in your official PAN card documentation. Key information to verify includes your name, date of birth, and any associated details that may appear. If you find discrepancies, it is crucial to take corrective measures. Sometimes, clerical errors during the issuance of the PAN may lead to mismatches, necessitating further actions.

If your details do not align, consider contacting the appropriate assistance via the designated helpline of the Income Tax Department or visiting a local tax office. They can guide you through the steps needed to amend your PAN records accordingly. Ensuring the accuracy of your PAN details is a critical step toward resolving any associated errors promptly and efficiently.

Step 2: Check for Typographical Errors

When encountering a “PAN number not valid” error, one of the critical steps to resolve the issue involves checking for typographical errors that may have occurred during data entry. These errors can arise from a myriad of sources, including fatigue during data input, hurried typing, or even miscommunication when relaying information. Common mistakes often include mixing up similar-looking characters, such as confusing the number “0” with the letter “O”, or “1” with “I”. Such seemingly minor errors can lead to significant issues when it comes to the validity of a Permanent Account Number (PAN).

To avoid typographical errors, meticulous attention to detail is paramount. First, it is advisable to confirm that the PAN is transcribed accurately from the original source. A good practice involves comparing the entered details against the official document. Furthermore, verifying each segment of the PAN, which consists of alphanumeric characters, is essential. For instance, the PAN format includes five letters followed by four numbers, concluding with one letter. Any deviation from this structure may indicate an error.

Another effective technique to minimize errors is to utilize a double-check method where a second individual reviews the entered information. This collaborative approach can significantly reduce the chances of oversight. Other helpful tips include breaking down the PAN into smaller segments and entering each segment viewable separately before combining them. Additionally, leveraging automated tools for input may help to alleviate human error; some forms may include auto-formatting features that decrease manual errors. By implementing these strategies, individuals can greatly enhance data accuracy, thereby decreasing the likelihood of encountering a “PAN number not valid” error.

Step 3: Update Your PAN Information

If you encounter a “PAN number not valid” error, it is crucial to ensure that your Personal Account Number (PAN) information is accurate and up to date. Discrepancies can arise due to various factors such as misspellings, incorrect identifiers, or a recent change of address. Fortunately, the process to rectify or update your PAN information can be accomplished through the official portals of NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology Services Limited). Here’s a detailed guide on how to proceed.

To begin the correction process, visit either the NSDL or UTIITSL website. Navigate to the “PAN Correction” section to access the online application form. For NSDL, select the “Reprint or Correction of PAN Card” option, whereas UTIITSL offers a similar service under their PAN services. It is important to choose the correct site as this can impact the processing of your application.

Once you are on the correct platform, fill out the application form carefully. It is essential to provide accurate and complete information to avoid delays. In cases where there are discrepancies in your name, date of birth, or address, ensure you submit supporting documents. These may include a copy of an identity proof, address proof, or any relevant documents that validate the corrections you are requesting. Commonly accepted documents are Aadhaar cards, passports, and voter IDs.

After submitting the application form along with the necessary documents, you will typically be required to pay a nominal fee for processing. This fee varies based on whether you are requesting a change within India or from abroad. After successful submission, you will receive an acknowledgment containing a unique number, which you can use to track the status of your application.

By following these steps, you can effectively ensure your PAN information is updated to reflect any changes, thus mitigating issues related to the validity of your PAN in the future.

Step 4: Contact Customer Support

When facing a “PAN Number Not Valid” error, reaching out to customer support can provide critical assistance in resolving your issue efficiently. The first step to contacting customer support for your PAN (Permanent Account Number) related concerns is to gather all relevant information related to your PAN. This includes your full name, date of birth, email address, and any documentation that links to your PAN, such as your PAN card or any previous communication with tax officials.

Once you have compiled the necessary information, you can reach customer support through various means. The primary channels include a dedicated helpline, email support, and sometimes even social media platforms where the tax authorities are active. For instance, the Income Tax Department of India offers a helpline that is accessible via phone numbers published on their official website. Often, you will also find an email address that allows you to submit your inquiries electronically.

When contacting customer support, it is efficient to have a list of suggested questions or topics to discuss. You might inquire about the correctness of your PAN details stored in their database, seek clarification on the validation process, or ask about any discrepancies that could be affecting your PAN validity. Be prepared to provide additional documents or details if necessary, as this may expedite the resolution process.

Furthermore, it is recommended to maintain a log of your interactions with customer support, including dates, the names of representatives spoken with, and any ticket references. This documentation can be invaluable in case you need to follow up on any unresolved issues. By utilizing customer support resources effectively, you can enhance your chances of remedying the “PAN Number Not Valid” error more swiftly and accurately.

Step 5: Use Online PAN Verification Tools

In today’s digital age, a variety of online PAN verification tools are available to assist users in efficiently validating their Permanent Account Number (PAN) data. These tools are designed to identify errors or discrepancies that may lead to the “PAN number not valid” error. Utilizing such resources can significantly enhance the user experience and streamline the resolution process.

Online PAN verification tools, provided by official entities such as the Income Tax Department of India, allow individuals to check the validity of their PAN. By entering the required details, such as the PAN number and date of birth, users can swiftly confirm the correctness of their PAN information. This not only saves time but also eliminates the hassle of lengthy manual checks, thereby making the process more accurate.

To make use of these tools, follow these steps:

- Visit the official website of the Income Tax Department.

- Navigate to the PAN verification section.

- Enter the required details, including the PAN number and date of birth.

- Submit the information to receive instant verification results.

Using these online tools offers several benefits. Firstly, they provide instantaneous feedback on the validity of the PAN, helping users promptly address any issues. Secondly, they reduce the risk of manual errors that may occur during data entry. Lastly, these tools enhance overall compliance with regulatory requirements, ensuring that individuals maintain accurate records. This is particularly beneficial for taxpayers and financial institutions that require verified PAN details for various transactions.

In summary, leveraging online PAN verification tools is an effective method to quickly identify and rectify any discrepancies, ultimately ensuring that users can resolve the “PAN number not valid” error with minimal effort.

Step 6: Keep Your Documents Ready for Any Verification

In the course of addressing the PAN number not valid error, it is crucial to be prepared for any potential verification requests from tax authorities. Keeping essential documents readily available can facilitate a smoother resolution process and help ensure compliance with regulations. Tax authorities may conduct verifications to confirm the validity of your PAN and associated details, so having the right documentation is of utmost importance.

One of the primary documents to maintain is your Aadhaar card. This official identification not only serves to verify your identity but is often linked to various tax-related processes. Including your Aadhaar number in your PAN application can help in seamless verification. Additionally, it is advisable to keep a copy of your identity proof, such as a voter ID, passport, or driving license, as these documents can substantiate your identity and address during any inquiries.

Moreover, retaining copies of any prior communications received from the tax department can prove invaluable. These may include notices or clarifications related to your PAN or other tax matters. By having this information on hand, you can provide a quick reference that may expedite the verification process. Other relevant documents might include your income tax returns, bank statements, and proof of residence, as these can provide an additional layer of verification if your financial situation comes into question.

In essence, being proactive by compiling these documents ensures that you are prepared should the tax authorities require further verification. Maintaining an organized file of these important records is an effective strategy to navigate potential issues associated with a non-valid PAN number, facilitating smoother interactions with tax officials and helping to resolve any discrepancies swiftly.

Frequently Asked Questions (FAQs)

The PAN (Permanent Account Number) serves as a crucial identifier for individuals in the Indian tax system. However, encountering a “PAN number not valid” error can be a cause of concern. Below are some frequently asked questions that address common concerns regarding this issue and possible solutions.

Why is my PAN number showing as not valid?

Your PAN may show as invalid due to wrong name, incorrect date of birth, Aadhaar mismatch, outdated PAN records, or IT portal server issues.

How do I check if my PAN is valid?

Visit the Income Tax portal → Quick Links → Verify Your PAN. Enter your PAN, name, and date of birth to confirm its validity.

Why is my PAN not matching with Aadhaar?

Differences in name, spelling, date of birth, or gender cause PAN–Aadhaar mismatch. Update either Aadhaar or PAN to make details identical.

Can server issues cause PAN not valid error?

Yes. During peak hours or maintenance, the Income Tax portal may fail to validate PAN temporarily.

What should I do if my PAN details are wrong?

Submit a PAN correction request (Form 49A) via NSDL or UTIITSL to update incorrect details like name or date of birth.

How long does PAN correction take?

Usually 7–15 days. Sometimes longer if verification requires additional documents.

Can I fix PAN not valid error online?

Yes. You can verify PAN online and update incorrect details online through NSDL or UTIITSL.

Why is PAN validation failing during KYC?

KYC fails when your PAN details don’t match the database or your Aadhaar details. Updating PAN or Aadhaar usually resolves this.

Does Aadhaar linking fix PAN not valid error?

Yes, if the error is due to Aadhaar mismatch. Once details match and linking is complete, PAN validates successfully.

Who should I contact if nothing works?

You can contact Income Tax e-filing helpdesk or NSDL/UTIITSL support to check PAN status or resolve database errors.

Conclusion: Final Thoughts and Best Practices

Having a valid Permanent Account Number (PAN) is essential for various financial and tax-related activities in India. It serves as a unique identifier for individuals and entities, making it obligatory for filing income tax returns, opening bank accounts, and conducting financial transactions. Mistakes in PAN details can lead to disruptions and complications, which makes it crucial for individuals to ensure their PAN information remains accurate and up-to-date.

To avoid the “PAN number not valid” error, individuals should engage in best practices regarding their PAN details. First and foremost, it is advisable to periodically check your PAN information. Verification through official resources should be conducted regularly, especially after any significant life events such as marriage or change of address, which may necessitate updates in personal details. Online portals provided by the income tax department facilitate easy access to verify and correct PAN-related information.

Another best practice involves maintaining documentation that supports your PAN application, including proof of identity, address, and date of birth. This helps in prompt resolution if any discrepancies arise. When filing taxes or making significant transactions, ensure that your name and other personal details are consistent with your PAN records to avoid potential errors that could delay processing.

Lastly, it is imperative to approach any challenges related to PAN validation with prompt action. Should an error occur, utilizing the relevant resources for correction, such as the online PAN correction facility, will tremendously simplify the process. By adopting these recommended practices, individuals can minimize problems associated with their PAN number and foster a smoother financial experience throughout their lives.

Discover more from HUMANITYUAPD

Subscribe to get the latest posts sent to your email.