Ponzi Scheme: 7 Shocking Facts You Must Know

What is a Ponzi Scheme?

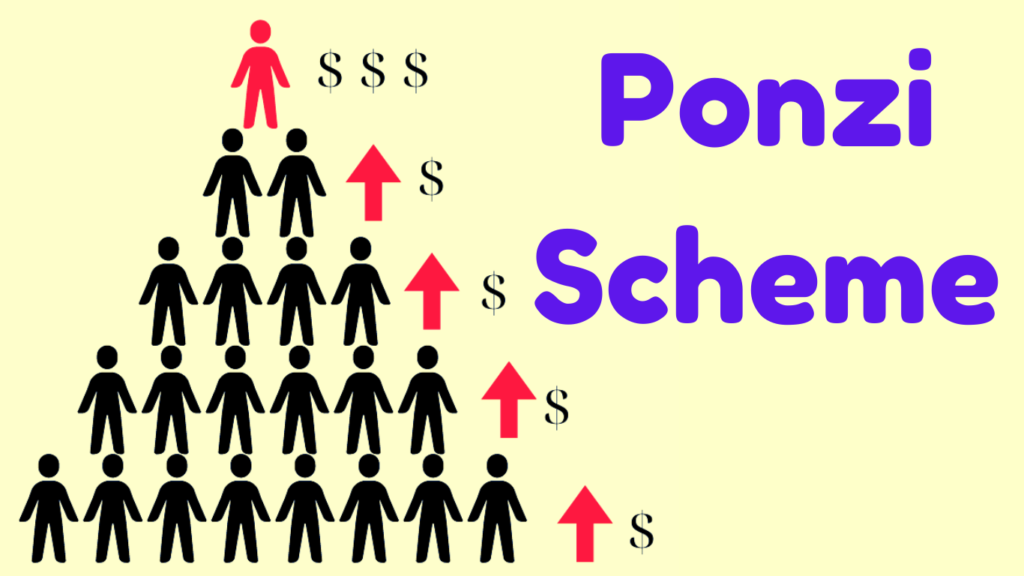

A Ponzi scheme is a form of investment fraud that lures investors and pays profits to earlier investors with funds from more recent investors. This type of fraudulent operation promises high returns on investments with little or no risk involved, which is a significant red flag. The scheme is named after Charles Ponzi, who became infamous for his investment approach in the early 20th century. Ponzi schemes create the illusion of a legitimate business through promises of extraordinary profits, but they fundamentally rely on the continuous influx of new investors to sustain payouts to earlier investors.

Sign up for HUMANITYUAPD

The operation of a Ponzi scheme typically involves the organizer attracting capital from new investors by marketing an attractive, though often fictitious, investment opportunity. They may claim to have a unique strategy for generating profits that is not available in traditional investments. The returns paid to existing investors are, in fact, derived from the contributions of newer participants rather than from legitimate profit-making activities. This deceptive practice perpetuates a cycle where the scheme must continually recruit new investors to remain solvent.

Due to the unsustainable nature of Ponzi schemes, they eventually collapse once the pool of new investors dries up. When the organizer can no longer recruit enough participants to meet the payout demands of earlier investors, the scheme disintegrates, leading to significant financial losses. It is important for potential investors to conduct thorough research and be wary of investment opportunities that promise unrealistic returns with little risk. Understanding the characteristics of Ponzi schemes is crucial in safeguarding personal investments and remaining vigilant against such fraudulent activities.

➡️ Table of Contents ⬇️

The Mechanics of a Ponzi Scheme

Understanding the mechanics of a Ponzi scheme is crucial for identifying potential scams and protecting oneself from financial loss. At its core, a Ponzi scheme operates through a fraudulent investment mechanism where returns are not generated from legitimate business activities but rather from the capital contributions of new investors. This model was popularized by Charles Ponzi in the early 20th century and has since been adapted by various fraudsters worldwide.

The organizer of the Ponzi scheme plays a pivotal role. They typically present themselves as knowledgeable investors or fund managers, promising exceptionally high returns that are often too good to be true. To entice initial investors, they usually offer guaranteed returns within an unrealistically short timeframe, creating a sense of urgency and allure.

Fund circulation in a Ponzi scheme is characterized by the constant recruitment of new investors. Each time a new individual joins the scheme, their funds are utilized to pay returns to earlier participants, thereby creating the illusion of profitability. The organizer may employ various tactics to sustain this flow of capital, such as promising additional incentives for referrals or using complex terminology to mask the scheme’s fraudulent nature.

As the scheme progresses, it relies increasingly on fresh investments to maintain payouts. This creates a fragile structure, as the sustainability of returns becomes contingent upon an ever-expanding base of investors. When recruitment inevitably slows down or new investments dry up, the scheme collapses, leaving the majority of investors with substantial losses. The organizer often vanishes with the remaining funds, leaving behind devastated investors who fall victim to the allure of quick profits.

It is essential for potential investors to remain vigilant and approach investment opportunities with caution, recognizing that if returns seem too attractive, it may be indicative of a Ponzi scheme. Awareness of these mechanics can significantly mitigate risk and foster informed investment decisions.

Historical Examples of Ponzi Schemes

Ponzi schemes have a long and notorious history, with several prominent examples showcasing the scale of deception involved. One of the earliest and most infamous cases is that of Charles Ponzi himself, who became the namesake of these fraudulent investment schemes in the early 20th century. Ponzi promised investors a 50% return in just 45 days by exploiting currency exchange rates, specifically through international postal reply coupons. His operation attracted thousands of investors, ultimately leading to losses of more than $20 million when the scheme collapsed in 1920.

Another well-known example is the scheme orchestrated by Bernie Madoff, which is considered the largest Ponzi scheme in history. Madoff, a formerly respected financier, operated his fraudulent investment advisory firm for decades, promising consistently high returns that defied market trends. By the time of his arrest in December 2008, Madoff had defrauded investors of approximately $65 billion. The scale of this deception had devastating effects on individuals, charities, and institutions alike, resulting in countless financial ruin.

Beyond these high-profile cases, several other Ponzi schemes have surfaced over the years, each reflecting different methodologies and levels of sophistication. For instance, schemes like those run by Scott Rothstein and Tom Petters exemplified how con artists exploit trust while creating a façade of legitimacy. Rothstein used his law firm as a front, claiming to provide high returns through fictitious investments in legal settlements. Petters similarly established a network of investments purportedly linked to consumer electronics, ultimately leading to a $3 billion fraud that affected banks and investors globally.

These historical examples serve as cautionary tales about the risks associated with Ponzi schemes and the complex ways in which they can deceive investors. Understanding the common characteristics of these fraudulent activities is essential for potential investors to recognize and avoid similar traps in the future.

Signs of a Ponzi Scheme

Identifying a Ponzi scheme can be challenging, particularly because these fraudulent operations often masquerade as legitimate investment opportunities. There are, however, several red flags that may indicate an investment is indeed a Ponzi scheme. Recognizing these signs is crucial for preventing financial loss and protecting oneself from potential scams.

One of the most significant indicators is the promise of unrealistically high returns. Ponzi schemes often advertise returns that are much higher than what is attainable in the established investment market. If an investment opportunity guarantees returns that seem too good to be true, it is worth investigating further, as genuine investments carry risks and typically yield moderate returns.

A lack of transparency regarding how the investment operates is another warning sign. Legitimate financial ventures are generally clear about their business model and their strategies for generating profits. In contrast, Ponzi schemes often provide vague explanations or refuse to disclose essential information that could help investors evaluate the opportunity. If you encounter opaque financial documentation or are unable to access information about the company’s operations, proceed with caution.

Furthermore, pressure to recruit new investors is a common tactic used by these schemes. Ponzi operators rely on the contributions from new investors to pay returns to earlier ones. If you encounter a scenario where there is a strong emphasis on bringing in additional investors, this may suggest that the structure is not sustainable and is likely a Ponzi scheme.

Inadequate financial documentation is also prevalent in fraudulent schemes. Legitimate investments should come with comprehensive reports detailing performance, risks, and financial statements. If the investment opportunity you are considering lacks sufficient documentation and accountability, this is a clear red flag that should not be ignored.

The Legal Implications of Ponzi Schemes

Ponzi schemes are not merely unethical investments; they are criminal offenses that carry significant legal consequences. Individuals who orchestrate these schemes can face serious charges, including securities fraud, wire fraud, and even money laundering. The severity of these charges typically depends on the scale of the operation and the amount of funds misappropriated from investors. Prosecutors can impose heavy penalties, which may include substantial fines and lengthy imprisonment, reflecting society’s commitment to maintaining financial integrity.

The consequences of running a Ponzi scheme extend beyond the perpetrators; they also have a profound impact on innocent investors. The financial losses incurred by victims can be devastating, leading to life-altering repercussions. However, there are avenues available for investors seeking recovery of their funds. Regulatory bodies such as the Securities and Exchange Commission (SEC) play a pivotal role in the investigation and prosecution of Ponzi schemes. The SEC actively works to safeguard investors by pursuing legal action against fraudsters and attempting to return stolen assets to those affected.

Additionally, the establishment of restitution funds may provide a pathway for victims to recover some of their lost investments. These funds are typically formed during legal proceedings and are designed to compensate the defrauded investors. Furthermore, various state and federal laws offer protections to investors, helping to create a more secure environment for financial transactions. Understanding these legal frameworks can empower investors to take action and safeguard their interests in the event of a suspected Ponzi scheme.

In summary, the legal ramifications for orchestrating Ponzi schemes are severe, with multifaceted implications for both the perpetrators and their victims. It is crucial for potential investors to remain vigilant and aware of the signs of fraudulent schemes, while also understanding the potential legal remedies available to them should they fall victim to such scams.

How to Protect Yourself from Ponzi Schemes

To effectively safeguard against Ponzi schemes, individuals must employ a range of strategies that focus on due diligence and critical assessment of investment opportunities. It is crucial to conduct thorough research before committing to any investment. This includes gathering detailed information about the investment itself, the individuals involved, and the company’s track record. One should investigate the claimed returns of the investment and compare them with the typical market rates. A legitimate investment opportunity will usually provide returns that are consistent with prevailing market conditions.

Verifying the legality of the investment is another essential step. Investors should consult reputable sources such as financial regulatory bodies and consumer protection agencies to confirm that the investment opportunity is registered and compliant with local laws. Checking for official documentation and ensuring that the investment firm is licensed can help in identifying potentially fraudulent schemes. Additionally, transparency is key; any lack of clarity regarding how the investment works or where the money is going should raise significant red flags.

Furthermore, trusting your instincts can play a vital role in avoiding Ponzi schemes. If an investment opportunity sounds too good to be true, it probably is. Offers that promise high returns with little risk should be approached with caution. Emotional pressure to invest quickly, as well as vague explanations about the business model, are common tactics used by perpetrators of these schemes.

Practical steps for consumers also involve developing a healthy skepticism towards unsolicited offers, whether they be through cold calls, emails, or social media. Taking the time to compare multiple investment options and seeking advice from experienced financial advisors can provide additional layers of protection. Ultimately, a proactive and informed approach is essential for minimizing the risk of falling victim to Ponzi schemes.

The Impact of Ponzi Schemes on Victims

Victims of Ponzi schemes often experience a continuum of emotional, financial, and social repercussions that can last for years. The most evident impact is financial loss, as investors typically lose their entire principal, with little to no hope of recovery. According to the Securities and Exchange Commission (SEC), losses from such fraudulent schemes can amount to millions of dollars, affecting not just individual investors but also their families and communities. The demise of life savings often leads to a profound sense of despair and hopelessness.

Beyond the financial implications, the emotional toll on victims can be devastating. Many individuals report feelings of betrayal and shame, complicating their ability to process their losses. Personal accounts reveal that victims may endure anxiety and depression, stemming from the realization that their trust in a seemingly legitimate investment opportunity was misplaced. This breach of trust can lead to a disillusionment with financial institutions, leaving victims hesitant to invest in legitimate opportunities in the future.

Socially, victims may find themselves alienated or stigmatized due to their circumstances. The shame associated with having been duped by a Ponzi scheme can lead to withdrawal from social activities and networks, fostering feelings of isolation. A sense of guilt can also prevent individuals from discussing their experiences, which inhibits healing and recovery. Statistics indicate that approximately 70% of Ponzi scheme victims do not report their experiences, fearing judgment and further stigma. The long-lasting effects of these personal and social consequences serve to highlight the severe impact these schemes have on individuals’ lives.

Understanding the multifaceted consequences Ponzi schemes have on their victims is crucial for raising awareness and promoting preventive measures against such financial fraud. As more information becomes available, it is imperative to advocate for better support systems for those affected.

Current Trends in Investment Fraud

Investment fraud, particularly in the form of Ponzi schemes, has seen a significant evolution with advancements in technology and the rise of globalization. These schemes now exploit the internet and digital platforms, making it easier for perpetrators to reach potential victims across the globe. With the proliferation of online investment opportunities, individuals are often lured by the allure of high returns with minimal risks. This accessibility has broadened the demographic spectrum of those targeted, encompassing younger investors alongside traditional demographics.

The increasing use of social media platforms as tools for recruitment has also marked a distinct shift in tactics. Scammers are adept at utilizing these platforms to craft seemingly legitimate investment opportunities and gather personal information from unwitting victims. This has led to a rise in the sophistication of scams, as fraudsters use well-designed websites and fake testimonials to establish credibility.

Moreover, the anonymity offered by online transactions allows fraudsters to operate without being easily traced, further complicating regulatory oversight. As investment landscapes become more digitalized, many individuals lack the necessary knowledge to discern static investment opportunities from façade Ponzi schemes, thus falling prey to deception.

In response to these challenges, authorities and financial regulatory bodies have initiated various preventive measures aimed at combating modern scams. These efforts include public awareness campaigns that educate the populace about the signs of investment fraud and utilizing technology to enhance scrutiny over online platforms. Tools such as investment fraud hotlines and dedicated online resources have been established to facilitate reporting and investigation.

Through collaborative efforts combining regulatory oversight, technological advancements, and public education, the fight against Ponzi schemes and other forms of investment fraud continues to evolve, aiming to protect vulnerable investors in a dynamic financial landscape.

Frequently Asked Questions about Ponzi Schemes

Ponzi schemes have garnered attention due to their deceptive nature and harmful impacts on investors. Below are some frequently asked questions that may help clarify your understanding of these illicit operations.

How can I report a suspected Ponzi scheme?

If you suspect you are witnessing a Ponzi scheme, it is crucial to act promptly. You should report the suspicious activity to the Securities and Exchange Commission (SEC) or your local state securities regulator. Additionally, consider filing a complaint with the Federal Bureau of Investigation (FBI) if you believe fraud is taking place. Providing detailed information, including the names of the parties involved and the nature of the operation, will assist authorities in their investigations.

What is the difference between Ponzi schemes and pyramid schemes?

Although both Ponzi and pyramid schemes involve deceptive practices, they differ in their structure. In a Ponzi scheme, returns are paid to earlier investors using the capital of new investors, without any legitimate profit-generating business. Conversely, pyramid schemes rely on recruitment, where members earn money by adding new participants to the scheme. Thus, while Ponzi schemes focus on investment returns with no real business, pyramid schemes incentivize recruiting new members to sustain the earnings of existing participants.

What should I do if I believe I am a victim of a Ponzi scheme?

If you believe you have fallen victim to a Ponzi scheme, it is essential to gather documentation regarding your investments. This includes records of transactions, correspondence with the promoters, and any promotional materials. Reach out to law enforcement, state regulators, and attorneys specializing in investment fraud for guidance. Additionally, filing a complaint with the SEC can initiate official actions against those responsible, potentially aiding in recovering lost funds.

Understanding these aspects of Ponzi schemes can arm individuals with the knowledge necessary to make informed decisions and protect themselves from financial deception.

Discover more from HUMANITYUAPD

Subscribe to get the latest posts sent to your email.