Cost Per Acquisition: 7 CPA Secrets For Growth Now

Understanding Cost Per Acquisition (CPA)

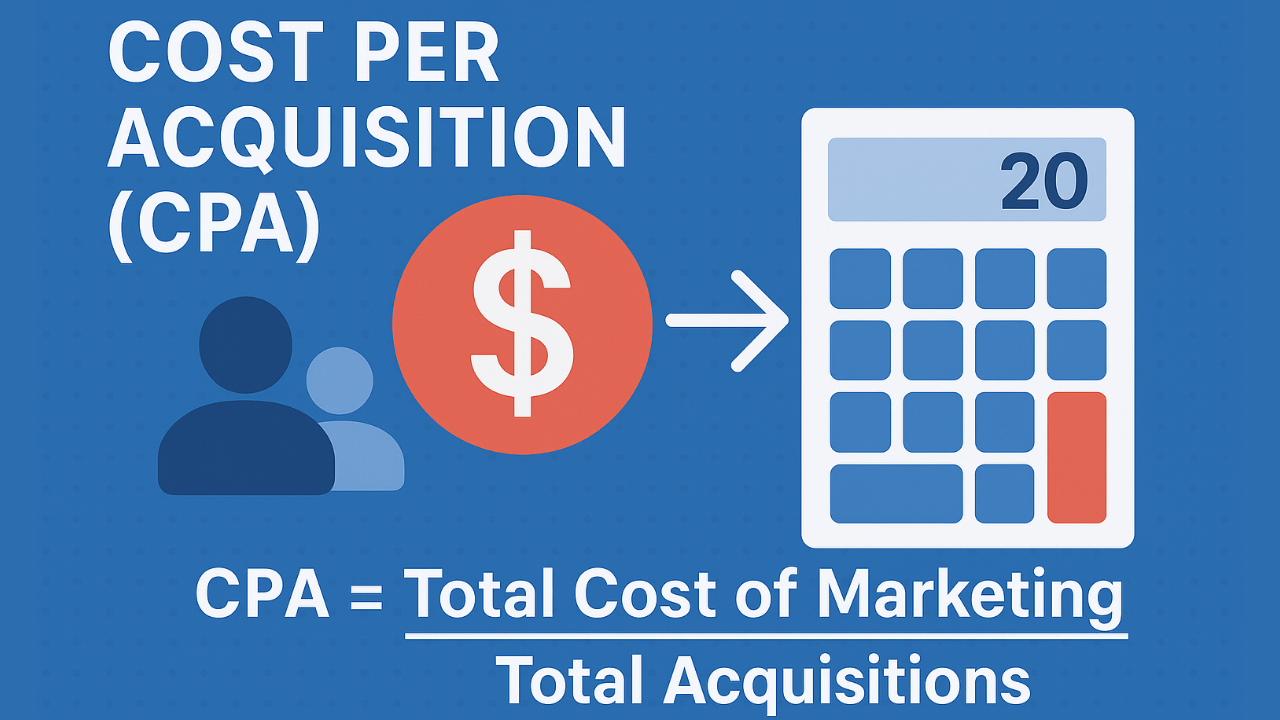

The concept of Cost Per Acquisition (CPA) is integral to the landscape of digital marketing and business performance evaluation. CPA refers to the total cost incurred by a business to acquire a new customer. This metric encompasses all expenditures related to marketing initiatives, including advertising spend, production costs, promotions, and any other associated expenses. Understanding CPA is crucial for businesses aiming to optimize their marketing efforts and enhance profitability.

Sign up for HUMANITYUAPD

Calculating the CPA is relatively straightforward. It involves dividing the total cost associated with acquiring customers within a specified timeframe by the number of customers acquired during the same period. For instance, if a business spends $1,000 on marketing and successfully acquires 50 new customers, the CPA would be $20. This simple formula allows organizations to gauge the efficiency of their marketing strategies and determine if the spending yields a satisfactory return on investment.

The importance of measuring CPA cannot be overstated, as it provides valuable insights into the effectiveness of different marketing channels and campaigns. By elucidating which strategies yield the lowest CPA, businesses can allocate resources more strategically, eliminating unproductive spending and reinforcing successful methods. This evaluation fosters a data-driven approach, allowing companies to adapt their marketing strategies for better performance.

Moreover, a well-managed CPA can have a profound impact on overall business profitability. By optimizing the cost to acquire each customer, businesses can improve their profit margins. Lowering CPA not only enhances customer acquisition strategies but also leads to more sustainable business practices. Thus, embracing CPA as a critical metric is essential for any organization seeking growth and long-term success in today’s competitive market.

➡️ Table of Contents ⬇️

The Importance of CPA in Digital Marketing

In the realm of digital marketing, understanding Cost Per Acquisition (CPA) is pivotal for any business aiming to optimize its marketing strategies. CPA represents the total cost incurred to acquire a new customer through a marketing campaign. This metric is essential for evaluating the effectiveness of various marketing channels and tactics. By focusing on CPA, businesses can make informed decisions about where to allocate their budgets, ensuring that they invest in the most profitable strategies.

One of the primary advantages of monitoring CPA is its direct correlation with return on investment (ROI). When businesses have a clear understanding of their CPA, they can assess whether their marketing efforts are yielding a reasonable return. This assessment allows for the optimization of marketing budgets, directing funds toward campaigns that deliver better acquisition rates. Consequently, by continuously analyzing and adjusting campaigns based on CPA, organizations can maximize their profitability over time.

It is also important to differentiate CPA from other commonly used metrics, such as Cost Per Click (CPC) and Cost Per Impression (CPI). While CPC focuses on the cost incurred each time a user clicks on an ad, and CPI measures the cost associated with every 1,000 impressions served, CPA goes a step further by reflecting actual customer acquisition. This distinction is crucial; merely driving traffic or impressions does not guarantee conversions, making CPA a more reliable indicator of marketing performance. In essence, understanding the nuances between these metrics enables marketers to create more targeted strategies that prioritize acquisitions over mere clicks or views, leading to more effective campaigns.

Calculating Cost Per Acquisition (CPA)

Calculating Cost Per Acquisition (CPA) is a crucial aspect of assessing marketing efficiency. The CPA formula is straightforward: it is determined by dividing the total cost of acquiring customers by the number of customers acquired during a specific time period. The formula can be represented as:

CPA = Total Cost of Marketing / Total Acquisitions

For instance, if you spend $1,000 on a marketing campaign and successfully acquire 100 new customers, your CPA would be:

CPA = $1,000 / 100 = $10

This means that it costs $10 to acquire each customer through this campaign. However, the calculation must consider all associated costs, which can include advertising spend, creative development, and any supplementary promotional expenses. Therefore, comprehensive tracking of expenditures is imperative for an accurate CPA analysis.

Additionally, conversion rates can significantly affect CPA figures. If a campaign leads to a higher conversion rate, the CPA may decrease, indicating enhanced marketing effectiveness. For example, if another campaign only spends $800 but converts 80 customers, the CPA would be:

CPA = $800 / 80 = $10

It is essential to remain vigilant for common pitfalls in CPA calculations. One of these pitfalls includes neglecting to account for all relevant costs associated with customer acquisition, which can yield misleading results. Additionally, spreading resources too thin across various campaigns can obscure the effectiveness of individual strategies, potentially inflating the perceived CPA. To avoid these issues, businesses should establish clear tracking methods, ensuring that all costs and conversions are accurately recorded and analyzed over consistent time periods.

Factors Affecting CPA

Cost Per Acquisition (CPA) is a crucial metric for marketers, reflecting the total cost associated with acquiring a new customer. Understanding the various factors that influence CPA can help businesses optimize their marketing strategies, ultimately enhancing their return on investment. One significant factor is the characteristics of the target audience. Demographics, interests, and online behavior affect how potential customers respond to marketing efforts. For instance, a company targeting millennials may employ different advertising approaches than one targeting baby boomers, resulting in varying acquisition costs.

Another essential consideration is the selection of marketing channels. Each platform, be it social media, email, or search engines, has distinct costs and effectiveness. For example, pay-per-click (PPC) advertising can lead to higher upfront costs but may result in lower CPA through effective targeting and conversion. Conversely, organic social media strategies tend to have lower costs but may require a longer time to see substantial results. Understanding each channel’s nuances can significantly impact overall CPA.

The effectiveness of ad copy and design also plays a crucial role in determining CPA. Compelling advertisements that resonate with the target audience are more likely to drive conversions. A/B testing different versions of ads can provide insights into what works best, ultimately lowering acquisition costs. Moreover, the user experience on the website bears considerable weight in converting leads into customers. A website that is easy to navigate and optimized for mobile devices can significantly enhance conversion rates, thereby lowering CPA.

Finally, seasonal trends can affect acquisition costs as certain times of the year may bring increased competition for attention and resources. Businesses should analyze past performance data to identify these trends, potentially adjusting their strategies during peak seasons to maintain cost-effectiveness. By understanding and optimizing these factors, businesses can strategically lower their CPA while enhancing customer acquisition efforts.

Strategies to Reduce CPA

Reducing Cost Per Acquisition (CPA) is vital for businesses seeking to maximize their marketing efficiency while ensuring a strong return on investment. Here are several actionable strategies aimed at achieving this goal.

Firstly, optimizing ad targeting can significantly decrease CPA. Utilizing precise targeting options available on platforms such as Google Ads and Facebook Ads ensures that advertisements reach the most relevant audience. By defining target demographics, interests, and behaviors, marketers can reduce wasted impressions and improve conversion rates. Regularly reviewing and adjusting targeting parameters based on performance data is essential for maintaining effectiveness.

Secondly, enhancing landing page design plays a critical role in influencing visitor behavior. A well-designed landing page that aligns with ad messaging and offers clear calls to action can lead to higher conversion rates. Marketers should aim for simplicity, ensuring that users are not overwhelmed and that their path to conversion is straightforward. Regular A/B testing of various design elements is recommended to identify optimal configurations.

Improving user experience is another vital strategy to decrease CPA. Ensuring a smooth and efficient journey for users, from the ad click to conversion, can lead to lower abandonment rates. This includes optimizing page load speeds, ensuring mobile responsiveness, and providing easy navigation. A positive user experience not only fosters conversions but also encourages repeat business.

Utilizing retargeting campaigns is an effective technique to re-engage users who have previously interacted with a brand but did not convert. By displaying tailored ads to these users across various platforms, businesses can remind potential customers of their interest, increasing the chances of conversion at a lower CPA.

Lastly, leveraging data analytics is crucial for informed decision-making. By closely analyzing campaign performance data, businesses can identify which strategies are effective and where adjustments may be necessary. Regularly reviewing metrics such as click-through rates, conversion rates, and customer acquisition costs will support continuous optimization efforts that ultimately aim to lower CPA.

The Role of A/B Testing in CPA Optimization

In the quest to optimize Cost Per Acquisition (CPA), A/B testing stands as a pivotal strategy that marketers can leverage. A/B testing, also known as split testing, involves comparing two variants of a marketing asset to determine which one performs better in terms of conversion rates. By modifying specific elements—such as headlines, visuals, or call-to-action buttons—marketers can gain valuable insights into what resonates with their audience and drives actions effectively.

One of the key advantages of A/B testing is its ability to provide data-driven results. For instance, if a company decides to test two different headlines for an advertisement, they may find that one performs significantly better than the other in attracting clicks and ultimately conversions. This not only helps lower acquisition costs but also enhances the overall effectiveness of marketing campaigns. The iterative nature of A/B testing fosters a culture of continual improvement, where each experiment builds upon the insights gathered from previous tests.

Consider a case study in which an e-commerce retailer implemented A/B testing on their email marketing campaigns. By testing different subject lines, they discovered that a more personalized approach yielded a 25% higher open rate. Consequently, this led to an increase in website traffic and sales while simultaneously decreasing CPA. Such examples underscore the effectiveness of A/B testing as a tool for refining marketing strategies and improving conversion rates.

In conclusion, the integration of A/B testing into CPA optimization strategies can significantly impact the effectiveness of marketing efforts. By engaging in systematic experimentation, marketers can identify high-performing elements, optimize their campaigns, and reduce acquisition costs over time. This approach not only contributes to enhanced profitability but also builds a more data-informed marketing practice. Through A/B testing, organizations can make informed decisions that lead to better outcomes while navigating the competitive landscape of digital marketing.

CPA and Customer Lifetime Value (CLV)

Understanding the relationship between Cost Per Acquisition (CPA) and Customer Lifetime Value (CLV) is crucial for businesses aiming to achieve sustainable growth. CPA refers to the total cost incurred to acquire a new customer, which can include marketing expenses, sales efforts, and other related costs. Conversely, CLV represents the total revenue a business can expect to generate from a customer throughout their entire relationship. Balancing these two metrics is essential for optimizing profitability and ensuring long-term success.

To achieve a healthy balance between CPA and CLV, businesses must first analyze their current customer acquisition strategies and the corresponding lifetime value of their customers. A high CPA may seem acceptable if the resulting CLV is significantly greater. However, if the cost to acquire customers exceeds the revenue they generate, businesses may struggle with cash flow and overall financial stability.

Additionally, understanding the factors that influence CLV is vital. These factors can include purchase frequency, average transaction value, and customer retention rates. By enhancing customer experience and satisfaction, businesses can increase their CLV and justify increased CPA, thus supporting a more sustainable growth trajectory.

The measure of CPA in relation to CLV also guides marketing strategies. If businesses can lower CPA through targeted marketing campaigns while simultaneously increasing CLV through improved customer engagement and loyalty programs, they can achieve a more favorable return on investment. In this context, monitoring and analyzing these metrics regularly enables businesses to make informed decisions and adjustments to their marketing tactics.

Ultimately, recognizing the interdependence of CPA and CLV is essential for informing business strategies. A thorough understanding of how these metrics interact will enable organizations to drive growth while maintaining a healthy bottom line.

Common CPA Mistakes to Avoid

When it comes to calculating Cost Per Acquisition (CPA), businesses often make critical mistakes that can lead to misleading insights. One of the most prevalent errors is failing to account for all acquisition costs. Many organizations focus solely on direct expenses, such as advertising costs, neglecting other significant factors like personnel, technology, and overhead costs. To achieve a comprehensive understanding of true CPA, it is essential to include all related expenses in the calculation. This holistic approach provides a more accurate picture of what it actually costs to acquire a new customer, allowing for informed decision-making.

Another common pitfall is not monitoring changes to CPA regularly. The digital landscape is ever-evolving, which means that the factors influencing CPA can shift frequently. If businesses do not establish a routine for analyzing their CPA metrics, they may fail to identify trends or optimizations. Regular monitoring allows companies to respond promptly to changes, ensuring they remain competitive. Implementing a systematic approach to analysis—perhaps through automated reporting tools—can greatly enhance the visibility of CPA-related performance.

Lastly, many businesses overlook the effects of seasonality when evaluating CPA. Various industries experience fluctuations that can significantly impact acquisition costs during certain periods. For instance, e-commerce businesses might see an uptick in CPA during holiday seasons due to increased competition. Failing to consider these seasonal impacts can lead to misguided strategies. To counter this, companies should conduct historical analyses of CPA, identifying peak periods and adjusting their acquisition strategies accordingly. By being mindful of these common mistakes, organizations can optimize their CPA calculations effectively, leading to a better understanding of their marketing efficiency and customer acquisition strategies.

FAQs About Cost Per Acquisition (CPA)

Cost Per Acquisition (CPA) is a pivotal metric in digital marketing, but many practitioners and businesses frequently have questions about its application and relevance. Here are some of the most common queries concerning CPA, along with their clarifications.

What is a good CPA?

Determining a “good” CPA depends significantly on your industry and business model. Generally, a lower CPA indicates a more efficient advertising campaign, but what constitutes an acceptable CPA varies. For instance, e-commerce businesses often aim for a CPA that is less than the average order value, while service-based companies may be willing to spend more per acquisition due to longer customer lifetime values. Regularly comparing your CPA against industry benchmarks can provide insights into whether your advertising spend is justified.

How can I track my CPA effectively?

To monitor your CPA accurately, it’s essential to establish clear tracking mechanisms. Using tools such as Google Analytics, Facebook Ads Manager, or specialized CRM systems can help you gather data efficiently. You should implement conversion tracking, which allows you to track when a user completes a desired action, such as signing up or making a purchase. Creating customized reports will enable you to analyze your CPA over time and across different campaigns, helping you to optimize your marketing efforts accordingly.

What tools are available for CPA analysis?

Numerous tools can assist in CPA analysis, with a focus on data tracking and reporting. Google Analytics is widely used for monitoring traffic and conversions, while advertising platforms like Google Ads and Facebook Ads provide built-in tools for CPA evaluation. Additionally, there are third-party analytics solutions such as HubSpot and SEMrush that offer more comprehensive insights into marketing performance. Leveraging these tools effectively equips marketers with the necessary data to refine their strategies and improve their CPA outcomes.

How can businesses lower their Cost Per Acquisition (CPA)?

Businesses can reduce their Cost Per Acquisition (CPA) by optimizing ad targeting, improving conversion rates, and refining marketing funnels. Effective audience segmentation ensures ads reach the most relevant users, minimizing wasted ad spend. Additionally, enhancing landing page design, speeding up website load times, and using compelling calls-to-action can increase conversions and reduce CPA. Regular A/B testing of campaigns and continuous data analysis allow marketers to identify cost-effective strategies that sustainably lower their overall Cost Per Acquisition (CPA).

Why is Cost Per Acquisition (CPA) important for business growth?

Cost Per Acquisition (CPA) is vital for business growth because it measures how efficiently a company converts marketing spend into actual customers. A well-managed CPA ensures that advertising budgets are used effectively, leading to a higher return on investment (ROI). By monitoring Cost Per Acquisition (CPA), businesses can identify high-performing marketing channels, optimize campaign performance, and focus resources on strategies that deliver measurable growth and profitability.

What factors can increase the Cost Per Acquisition (CPA)?

Several factors can cause an increase in Cost Per Acquisition (CPA), including poor audience targeting, low-quality ad creatives, and ineffective landing pages. High competition in digital advertising markets can also drive up bid costs, directly impacting CPA. Additionally, a slow or confusing checkout process can reduce conversions, leading to a higher CPA. To prevent rising acquisition costs, businesses should continuously optimize campaigns, monitor analytics, and align marketing efforts with customer behavior trends to maintain a balanced and efficient Cost Per Acquisition (CPA).

Discover more from HUMANITYUAPD

Subscribe to get the latest posts sent to your email.